|

E*TRADE vs TradeZero (2024)

E*TRADE or TradeZero—which is better in 2024? Compare margin accounts, online trading fees, stock broker extended hours, and differences.

|

Overview of TradeZero and E*Trade

E*Trade is a well-known brokerage with memorable TV ads. TradeZero, on the other hand, is less recognized. Could E*Trade customers be missing out on a better deal? Let’s explore.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Etrade

|

$0

|

$0

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

TradeZero

|

$0

|

na

|

$0.59 per contract

|

$0

|

na

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Etrade

|

|

|

|

|

|

|

|

TradeZero

|

|

|

|

|

|

|

First Category: Available Assets

TradeZero offers just three types of securities for trading:

- Equities

- Exchange-traded Funds

- Option contracts

E*Trade offers these three and adds:

- Bonds

- Mutual Funds

- Futures (including crypto contracts)

- IPOs

Winner: E*Trade

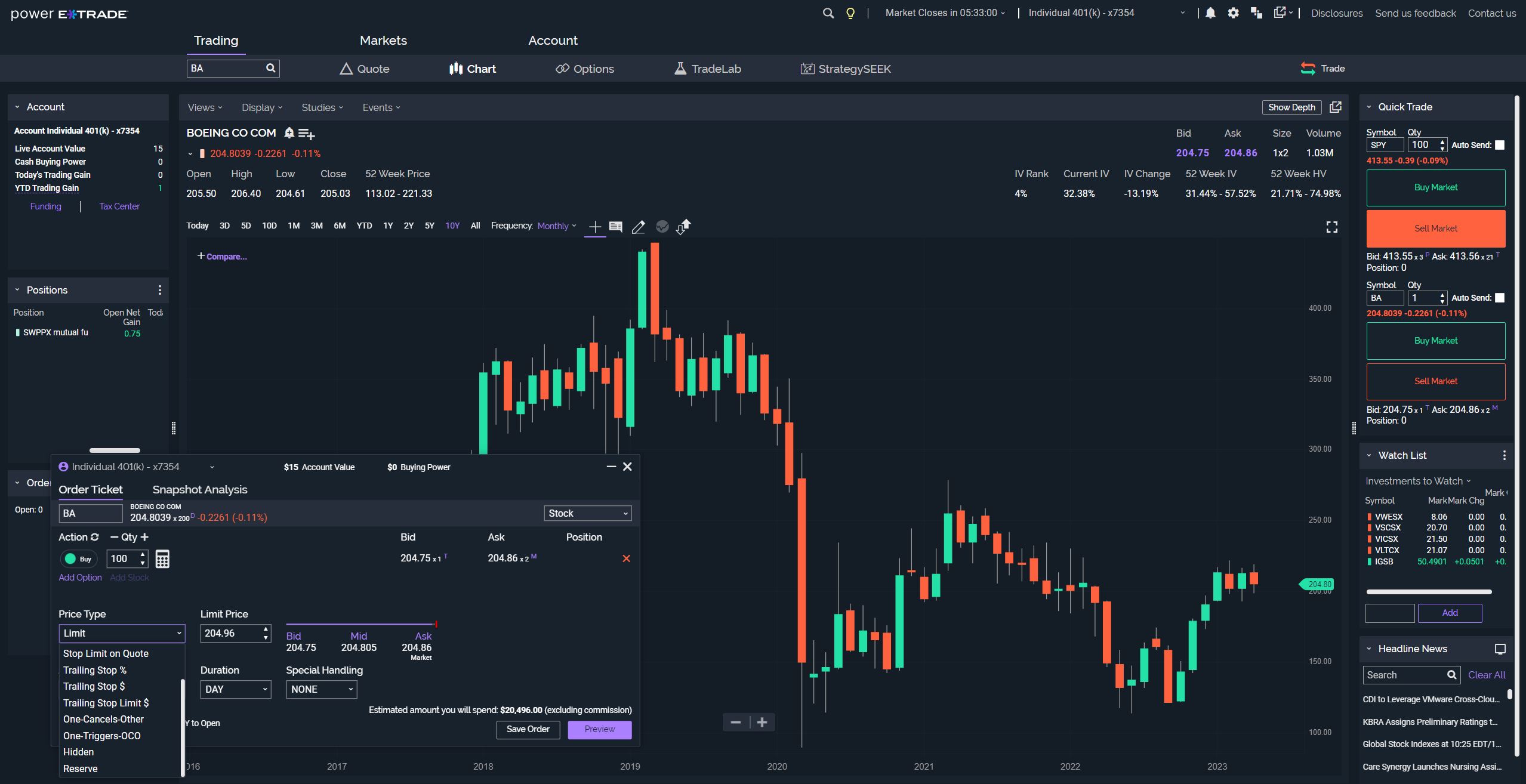

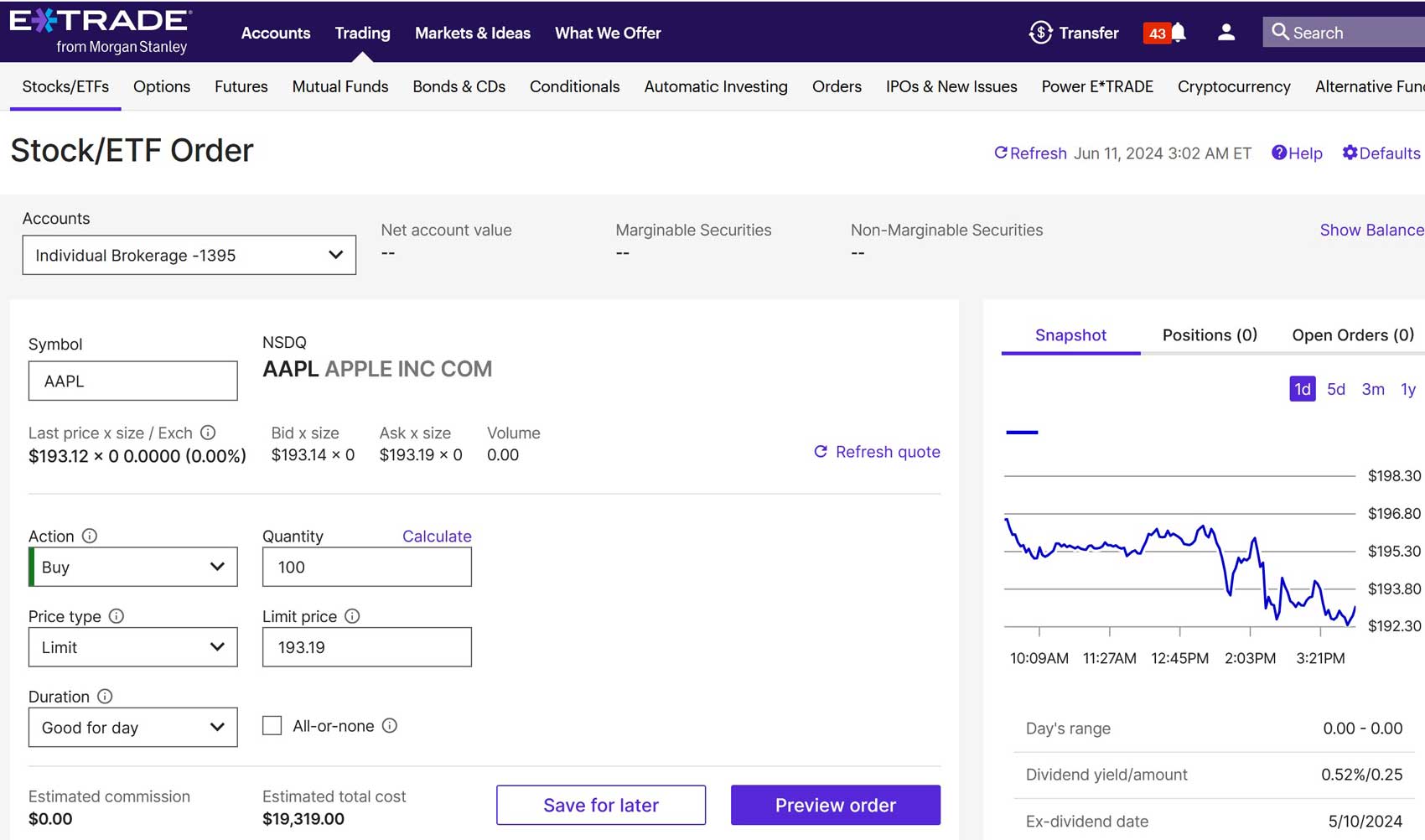

Second Category: Web-Based Trading

E*Trade and TradeZero both offer browser-based platforms. TradeZero actually has two, one of which costs $59 per month and includes Level II quotes, something E*Trade’s browser platform doesn’t have. However, TradeZero’s free platform lacks options trading, which E*Trade does offer.

E*Trade’s platform is more advanced than TradeZero’s free version, but it lacks a short locate tool, which TradeZero’s free platform includes.

Winner: Tie

Third Category: Desktop Software

For more demanding traders, both firms offer desktop platforms. E*Trade requires a $1,000 account balance to use its Pro platform, which is free and includes many advanced tools.

TradeZero offers ZeroPro, a desktop platform with similar advanced features, but it costs $79 per month unless you trade 100,000 shares in a month, making it a more expensive option.

Winner: E*Trade

Fourth Category: Mobile Apps

Both firms offer mobile apps. E*Trade has two apps: one for heavy trading, including futures, and another with features like mobile check deposit and streaming video news.

TradeZero’s app lacks some of E*Trade’s features, such as options trading, but does include a short locate tool. E*Trade’s app outperforms in charting and news.

Winner: E*Trade

Fifth Category: Day Trading and Swing Trading

Shorting: Both firms allow short selling, but only TradeZero has a short locate widget. E*Trade customers need to sign up for eligibility to trade hard-to-borrow stocks.

Extended Hours: TradeZero’s pre-market session starts at 4:00 am EST, earlier than E*Trade’s 7:00 am start. Both firms have the same after-hours period, but E*Trade offers overnight trading in some ETFs, which TradeZero doesn’t.

Level II Quotes: Both firms offer Level II data. TradeZero charges for it, while E*Trade provides it free for accounts with at least $1,000.

Direct-access Routing: TradeZero offers 9 venues, while E*Trade has only 2.

Margin: E*Trade’s margin rates range from 11.45% to 13.45%. TradeZero charges a flat 9% in the US.

Routing Fees and Rebates: TradeZero offers maker-taker fees, while E*Trade does not.

Pattern Day-Trading Rule: TradeZero’s Bahamian branch allows circumvention of the $25,000 PDT rule, which E*Trade does not.

Winner: TradeZero

Sixth Category: Other Services

Dividend Reinvestment Program: E*Trade offers DRIP, while TradeZero does not.

IRAs: You can open an IRA at E*Trade, but not at TradeZero.

Winner: E*Trade

Top Competitors

Recommendations

- Mutual Fund Traders: E*Trade for obvious reasons.

- Beginners: E*Trade for its 24/7 customer service and excellent educational resources.

- Long-Term Investors and Retirement Savers: E*Trade is the clear choice for financial planning services, retirement account options, and branch locations.

- Small Accounts: E*Trade.

- Stock/ETF Trading: E*Trade offers better stock and ETF research materials, along with free software, making it our top pick.

Promotions

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

TradeZero:

Trade stocks, options & ETFs for free.

TradeZero vs E*Trade Summary

Despite being less known, TradeZero competes well with E*Trade and even surpasses it in some day-trading features. However, E*Trade remains the stronger choice overall.

Updated on 8/23/2024.

|