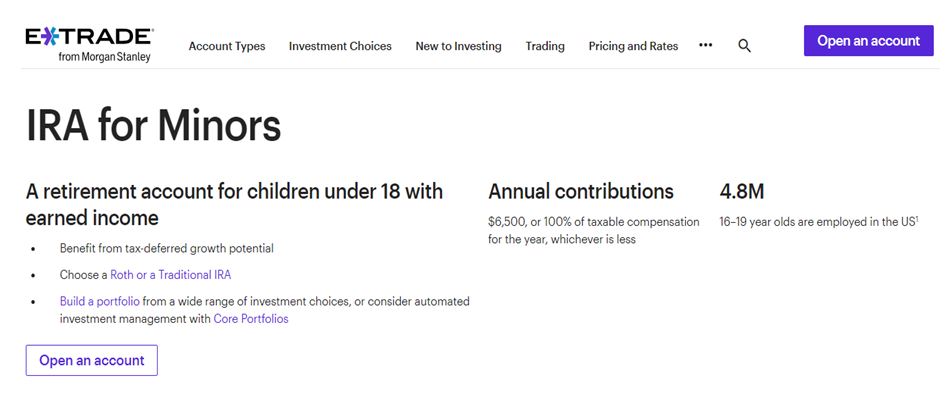

E*Trade’s IRA for Minors

Tax-deferred investing isn't just for adults. With E*Trade’s IRA for Minors, young people can start saving for retirement and more, all at a low cost. Read on for more details.

IRA for Minors Overview

An Individual Retirement Account for Minors is exactly what it sounds like: an IRA for kids. Like any other IRA, earned income is required, meaning the child must have some type of job.

At E*Trade, an IRA for Minors can be opened in either Roth or Traditional format. In both cases, the annual contribution limit is the same (currently $6,500 per year).

Opening an IRA for Minors at E*Trade

With E*Trade’s mobile app or website, you can open a juvenile IRA. On the mobile app, click on the small icon in the upper-left corner. This will open a menu with a link to start a new account. Tap on this link, and you’ll see a list of accounts. At the top, there is a drop-down menu for account categories. Select retirement, then scroll down to the section for IRA for Minors. Tap the link to start the application.

On the website, ignore the purple button at the top to open an account, as the IRA-for-Minors application won’t be found there. Instead, scroll to the bottom of the page and look for the link to open an account (under the ‘Quick Links’ heading). On the next page, look under the ‘Brokerage’ tab for the IRA-for-Minors account.

Both the website and mobile app lead to the same digital application, provided through a partnership with DocuSign. If you find this system difficult, E*Trade also offers a PDF application for the IRA for Minors. This fillable form requires no handwriting, except for the signature at the end. Once completed, images of the form need to be created using a smartphone, scanner, or another device, and submitted to E*Trade. The website and mobile app both offer a convenient upload tool.

Potential Investments in an IRA for Minors at E*Trade

An IRA of any type at E*Trade has access to the same range of investments as taxable accounts. Available assets include bonds, options, stocks, futures contracts, and funds (mutual, exchange-traded, and closed-end). These asset classes are available if the IRA for Minors is opened as a self-managed account. It’s also possible to open the IRA for Minors in robo mode, where a software program will select ETFs for the account.

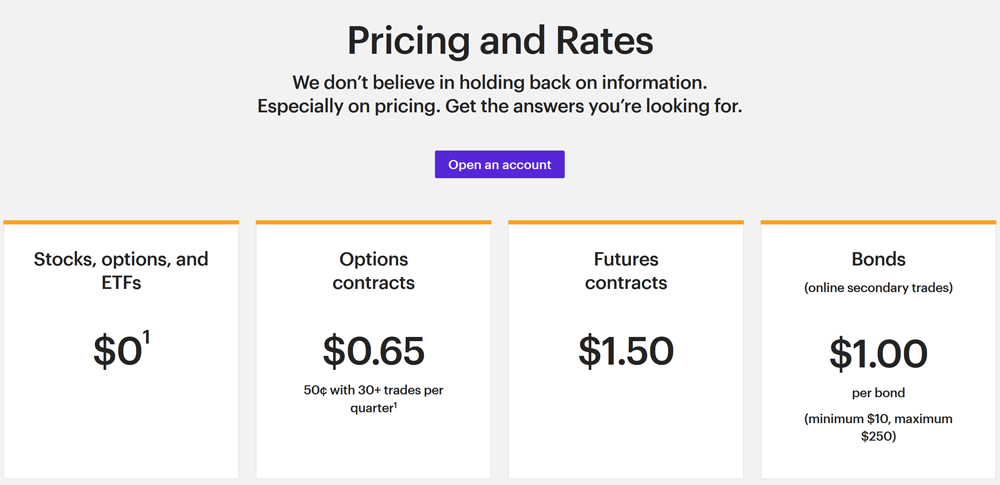

Pricing Schedule for E*Trade’s IRA for Minors

One of the great features of E*Trade’s retirement account for children is its fee schedule. There are no ongoing account fees of any kind for brokerage IRAs—no annual, maintenance, low-balance, withdrawal, or inactivity charges. A robo IRA will cost 0.30% per year. An IRA can be opened with any deposit or no deposit at all, making it very convenient.

Once the adolescent IRA is open, it will follow E*Trade’s standard commission schedule, which includes zero commissions on stocks, ETFs, and mutual funds.

Transferring an Existing IRA for Minors to E*Trade

An existing IRA for Minors at another investment firm can be transferred to the same account type at E*Trade. On E*Trade’s main mobile app, tap the Menu icon at the bottom. Next, select the Transfer link near the top of the page. On the next page, scroll down and tap the link to transfer an account. Make sure to specify an IRA for Minors (with the correct tax structure, Roth or Traditional) as the account type at the old investment firm.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Taxation of an IRA for Minors

An IRA for Minors is taxed the same way as other IRAs. This means funds can be withdrawn penalty-free for various uses beyond retirement. For example, funds can be withdrawn before age 59½ without the standard 10% IRS penalty when used for qualified educational expenses (income taxes do apply to any earnings withdrawn from a Roth for this purpose, and a Traditional setup will see income taxes on both earnings and contributions). A first-time home purchase is also allowed.

Charles Schwab’s Custodial Account as a Substitute

The major drawback of the IRA for Minors account is the requirement of earned income on the part of the child. This restriction is eliminated with a custodial account. With this account type, any amount can be contributed with or without earned income, and there is no annual contribution limit.

A custodial account can be opened at Charles Schwab with zero fees and no minimum deposit requirement. Schwab offers both the UGMA and UTMA accounts, meaning residents of all 50 states, Puerto Rico, and the U.S. Virgin Islands can participate.

Schwab’s account application can be accessed on its website or mobile app. A custodial account can be opened through either method, and the form takes just a few minutes to complete.

Free Charles Schwab IRA Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Updated on 7/19/2024.

|