TIAA vs Fidelity in 2024

Fidelity or TIAA CREF—which is better? Compare IRA/Roth accounts, online investing fees, stock broker mutual fund rates, and differences.

TIAA vs. Fidelity and Schwab: Key Points

• You can open brokerage and advisory accounts at TIAA, Schwab, and Fidelity.

• Fidelity and Schwab offer cash-management services.

• Schwab offers the best trading software.

TIAA vs. Fidelity and Schwab Overview

If you’re considering a brokerage firm for your investments, TIAA, Fidelity, and Charles Schwab are all solid options. Here’s a closer look at these three firms:

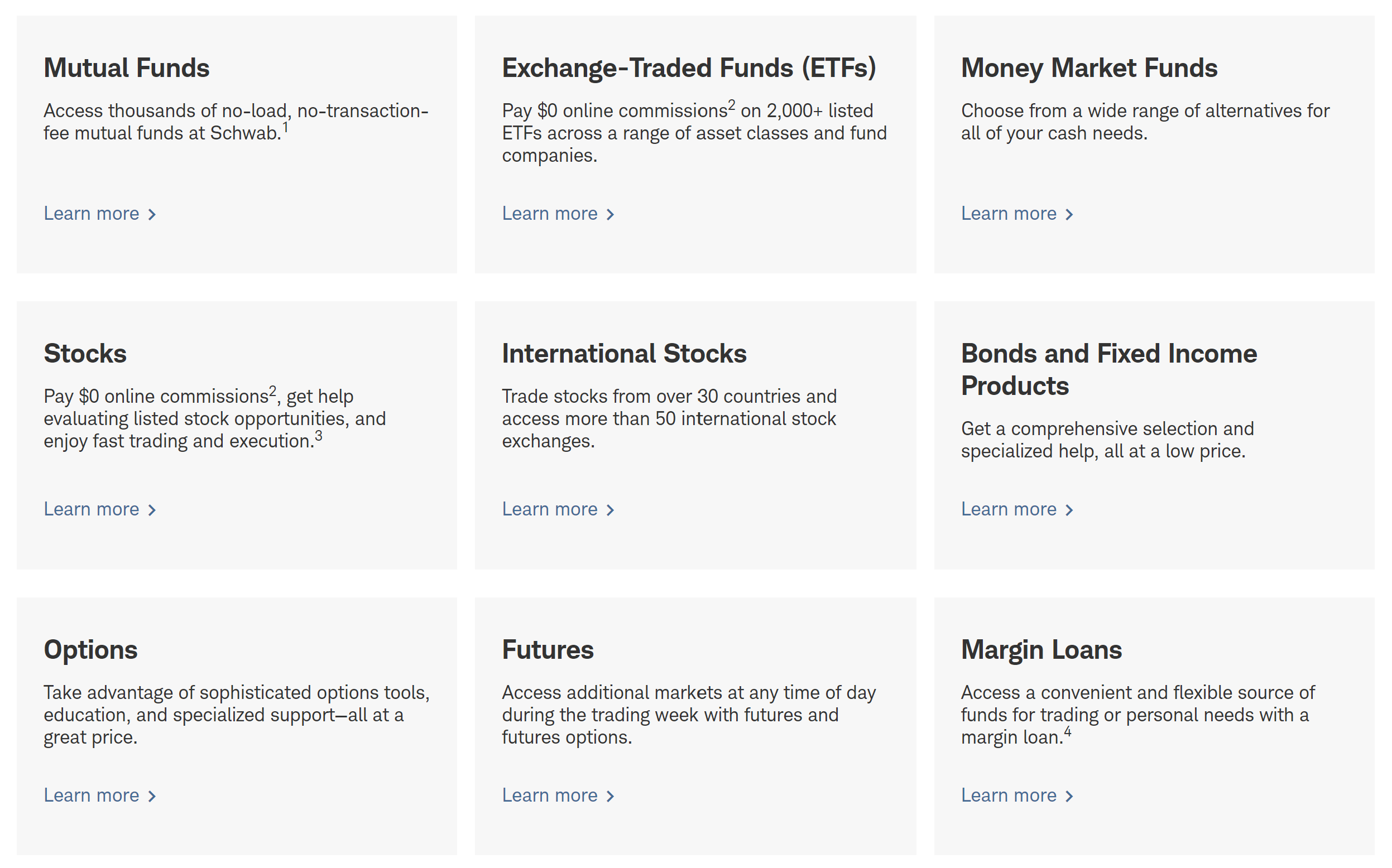

Investing Options

All three firms offer brokerage and managed accounts. Fidelity and Schwab include robo-advisory services in their programs, with Fidelity having no minimum requirement and Schwab’s service being free. You can also access human financial advisors at branch locations for all three firms.

Self-directed customers can trade in the following asset classes at all three firms:

- Stocks

- Bonds and other fixed-income securities

- Option contracts

- ETFs

- Closed-end funds

- Mutual funds

All three firms offer over-the-counter (OTC) stock trading, while Schwab and Fidelity provide access to some foreign exchanges. Schwab also offers futures and forex trading, while Fidelity has a cryptocurrency service.

Winner:

Winner: Tie between Fidelity and Schwab

Banking Services

TIAA Bank has closed, so TIAA no longer offers cash-management services. In contrast, Schwab operates Schwab Bank, which provides checking and savings accounts, as well as services like mortgage loans.

Fidelity doesn’t have a bank, but it offers debit cards and checkbooks linked to hybrid brokerage-bank accounts. Both Fidelity and Schwab offer money market funds, some of which currently yield around 5.0%.

Neither Fidelity nor Schwab charges fees for their banking products. Checkbooks and debit cards are free, and both offer ATM fee refunds. Schwab provides worldwide ATM refunds, while Fidelity offers cash bonuses through its Bloom program.

Winner: Tie

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Vanguard:

Open a Vanguard investment account.

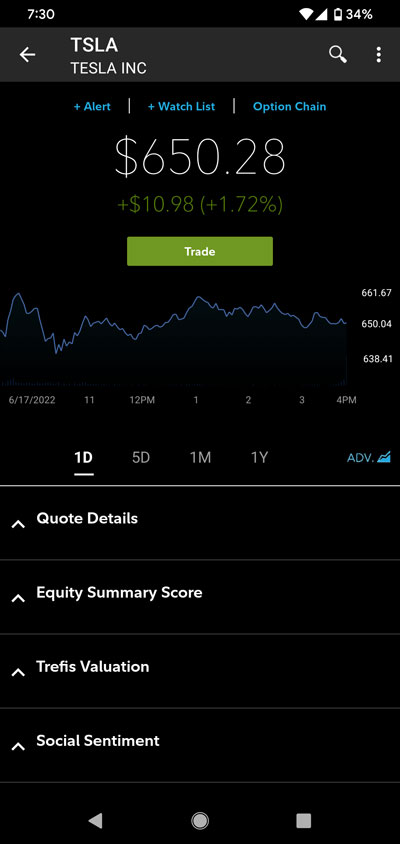

Margin Accounts

All three firms offer margin trading in their brokerage accounts. Fidelity and Schwab provide easy online tools to switch an account to margin status. TIAA requires a form to be downloaded, signed, and returned.

Once enabled, margin accounts incur interest charges. Schwab’s and Fidelity’s rates start at 12.825% and go as low as 11.075%. TIAA’s rates range from 11.875% to 10.875.

Winner: Close competition

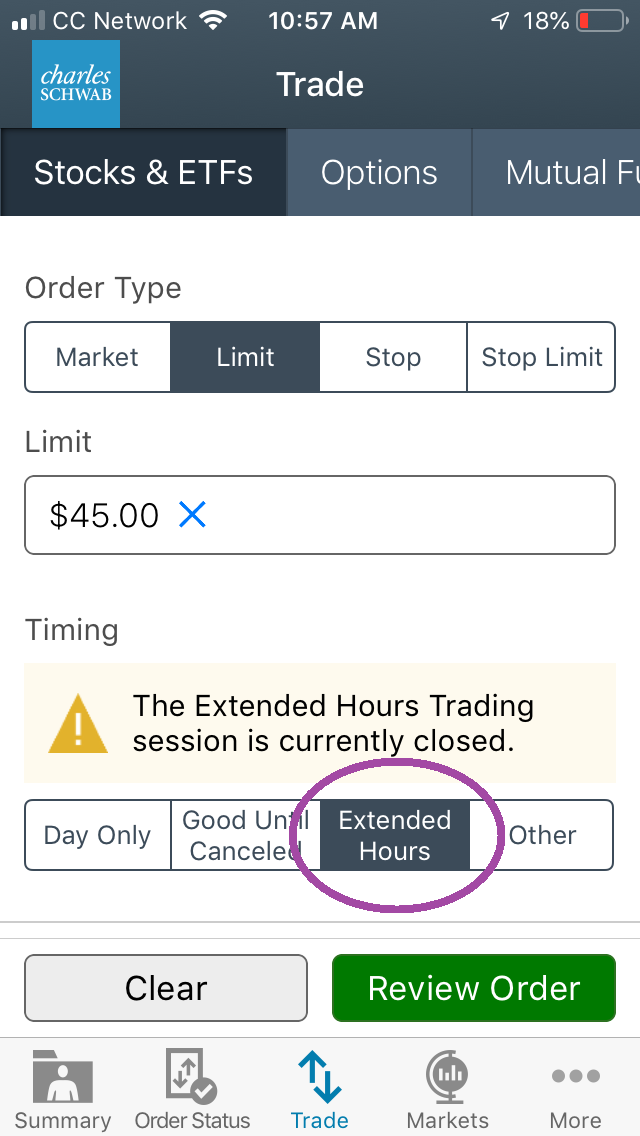

Websites

TIAA’s website, while offering margin accounts, lacks advanced trading capabilities and does not support a browser platform. Charting is basic, with limited technical indicators and company events.

Schwab, on the other hand, offers a browser platform called thinkorswim, which is much more advanced. Schwab’s website is also robust, offering advanced order types and pro-level features like Level II quotes.

Fidelity’s website doesn’t have a browser platform, but it offers advanced features like basket, conditional, trailing, and recurring orders. The charts and option chains are advanced, and the Full View platform links to other financial accounts.

Winner:

Winner: Schwab

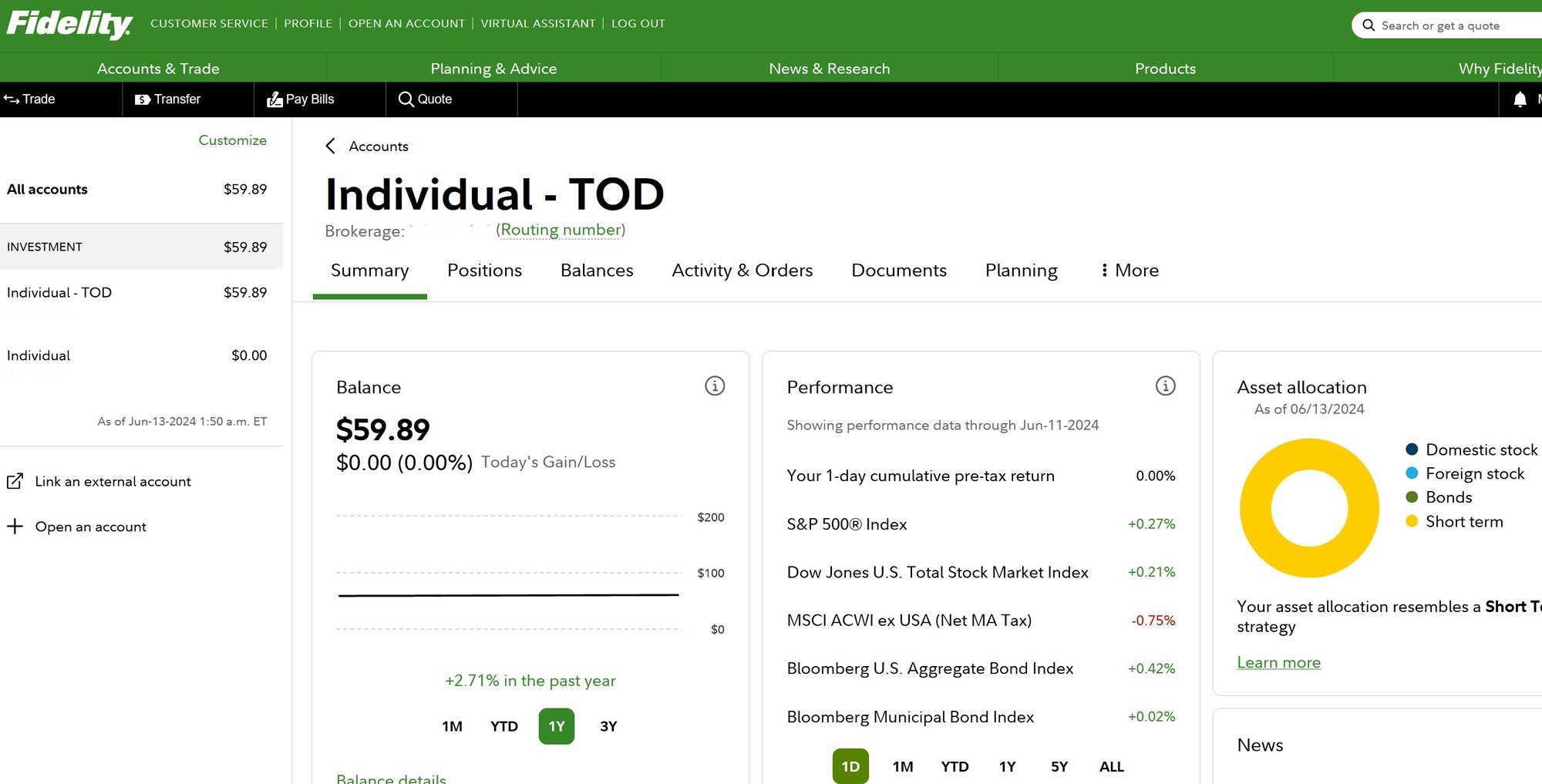

Mobile Apps

TIAA’s mobile app is even simpler than its website, with no charting tools and basic order types like limit, market, stop, and stop-limit.

Fidelity’s app is more advanced, featuring a virtual chat bot, market news, mobile check deposit, and horizontal charting with several tools.

Schwab offers two apps: a basic one and the thinkorswim app for advanced trading. Combined, they provide a high level of trading and account management, with thinkorswim’s order ticket offering many professional-level trade types.

Winner:

Winner: Schwab

Desktop Programs

Fidelity and Schwab both offer advanced desktop platforms with numerous tools, with Schwab’s thinkorswim platform offering the most technical indicators.

TIAA does not offer a desktop program.

Winner: Schwab

Extra Services

IRA Services: Personal and business IRAs are available at all three firms.

Fully-Paid Stock Lending: Available at Fidelity and Schwab, but not at TIAA.

Fractional-Share Trading: All three firms offer this service, but Schwab limits it to the 500 stocks of the S&P 500.

Extended Hours Trading: Available at Schwab and Fidelity.

Recurring Mutual Fund Purchases: Available at all three firms.

Dividend Reinvestment Plans: All three firms offer DRIP.

IPO Access: Provided by Fidelity and Schwab.

Winner: Fidelity

Recommendations

Small Accounts: Fidelity is recommended for small advisory accounts due to its no-minimum robo service. None of the firms have minimums for self-managed accounts.

Stock and ETF Trading: Schwab is the top choice.

Retirement Planning & Long-Term Investing: For self-directed investors, Fidelity and Schwab are better. For advisory services, any of the three would work well, especially with a local branch office.

Mutual Funds: TIAA offers 11,366 mutual funds, Schwab 5,948, and Fidelity 9,344. Schwab has the best fund screener. It’s a toss-up.

Beginning Investors: A managed account with any of the three is recommended for beginners.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Vanguard:

Open a Vanguard investment account.

Final Verdict

While TIAA excels in retirement planning, it doesn’t match the trading capabilities of Fidelity and Schwab.

Open Charles Schwab Account

Open Schwab Account

Open Fidelity Account

Open Fidelity Account

Updated on 8/23/2024.