|

Wellstrade/Wells Fargo vs Robinhood in 2024

Robinhood versus Wellstrade Wells Fargo which is better? Compare IRA/Roth accounts, online trading fees, stock broker rates.

|

Introduction

Robinhood and WellsTrade are two brokerage firms with very different focuses. They attract different types of traders, and their pricing structures vary in certain areas. Let’s take a closer look at these two companies to see which one stands out—Robinhood or Wells Fargo.

Pricing

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Robinhood

|

$0

|

na

|

$0

|

$0

|

$0

|

|

Wellstrade

|

$0

|

$35

|

$0.65 per contract

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Robinhood

|

|

|

|

|

|

|

|

Wellstrade

|

|

|

|

|

|

|

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

WellsTrade:

Open a Wells Fargo investment account.

Research and Education Tools

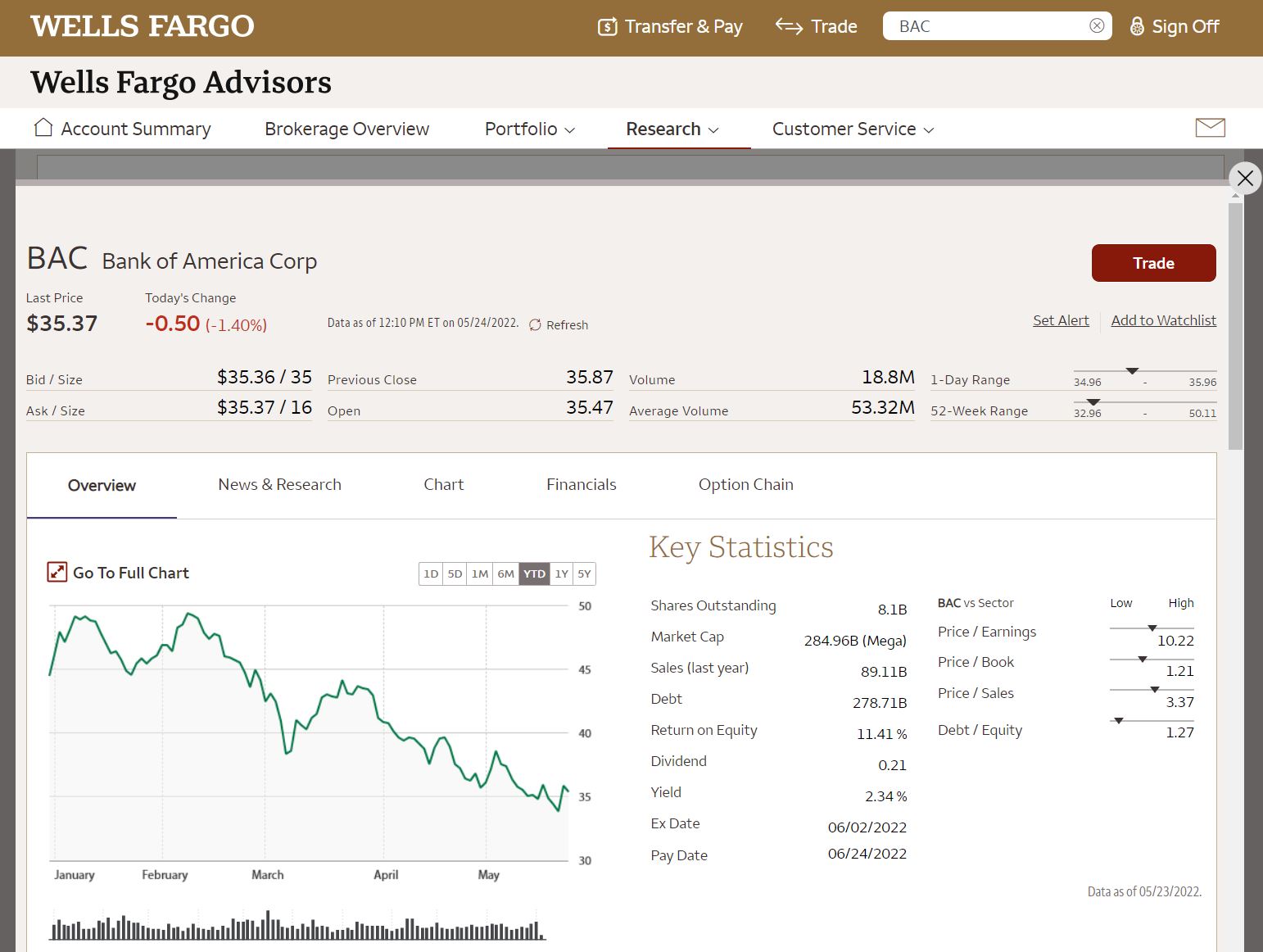

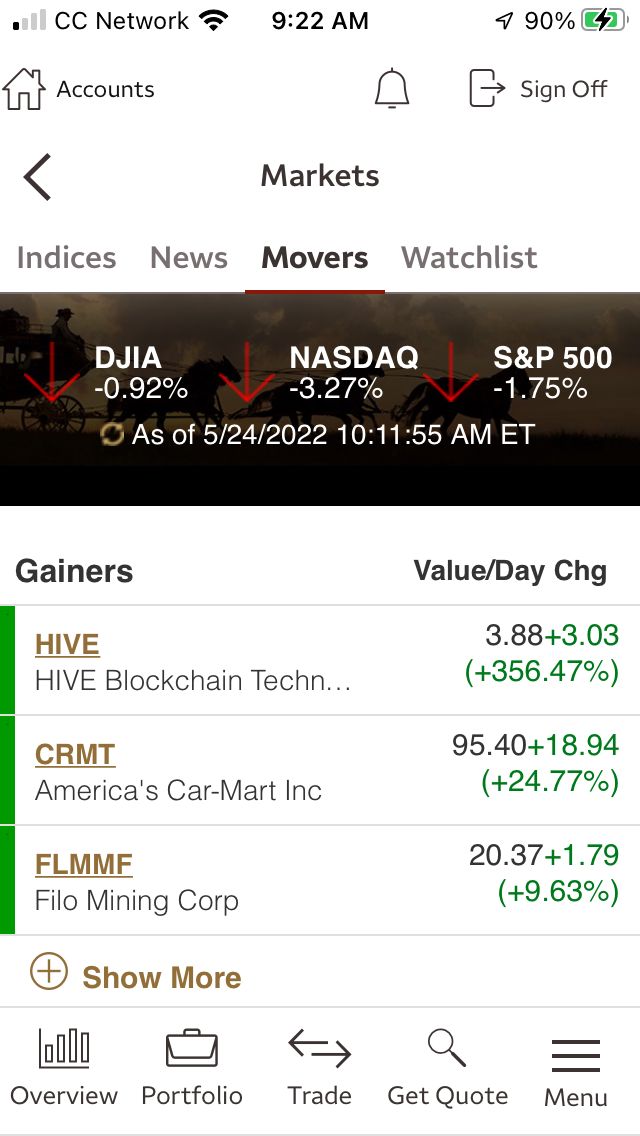

WellsTrade clients have access to market news and commentary on the broker’s website. Articles written by Wells Fargo investment advisors can be downloaded in PDF format at no charge. Prices are shown for a variety of indexes and commodities. Effective screeners can search for securities offered by the firm. Morningstar stock reports are available for free.

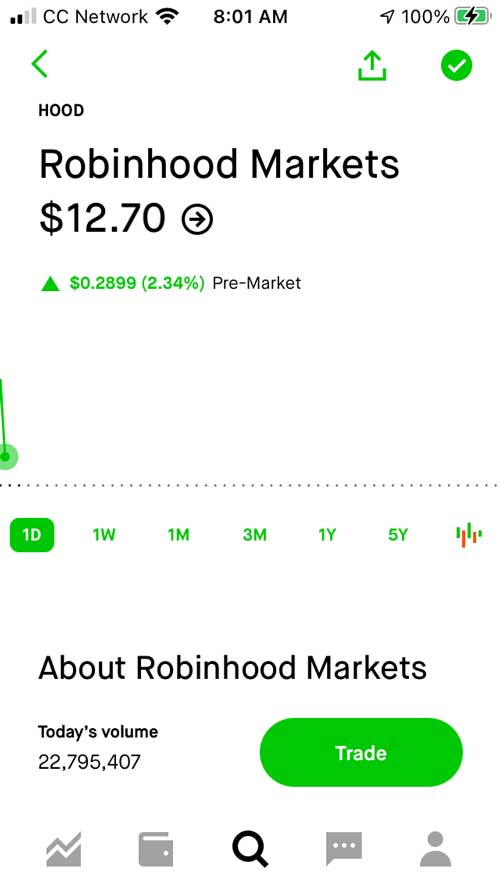

Robinhood offers fewer resources. There are several FAQs on Robinhood’s website, mostly covering topics related to opening and maintaining a brokerage account. There are very few resources for security research or education. Limited stock research is available on the Robinhood mobile app.

WellsTrade takes this category.

Trading Tech

The Robinhood website isn’t designed for trading. It primarily serves as a resource for account applications and marketing, with no trade bar or desktop platform available.

Trading and security research take place on the Robinhood mobile app. While charts are available, they are basic, with no technical studies or drawing tools. Line format is the only chart style provided. The Robinhood app is also available for Apple Watch.

WellsTrade’s website is designed for security research, charting, and order placement. Although there is no trade bar or desktop platform, charting on the website includes technical studies and comparisons. There are some drawing tools, though the chart cannot be displayed full screen.

While WellsTrade doesn’t have an Apple Watch platform, it does offer a mobile app for Android and Apple devices. The app includes options chains, charting, and market news relevant to specific stocks. Orders for mutual funds can also be placed through the app.

WellsTrade is clearly the better choice here.

The Cost of Trading

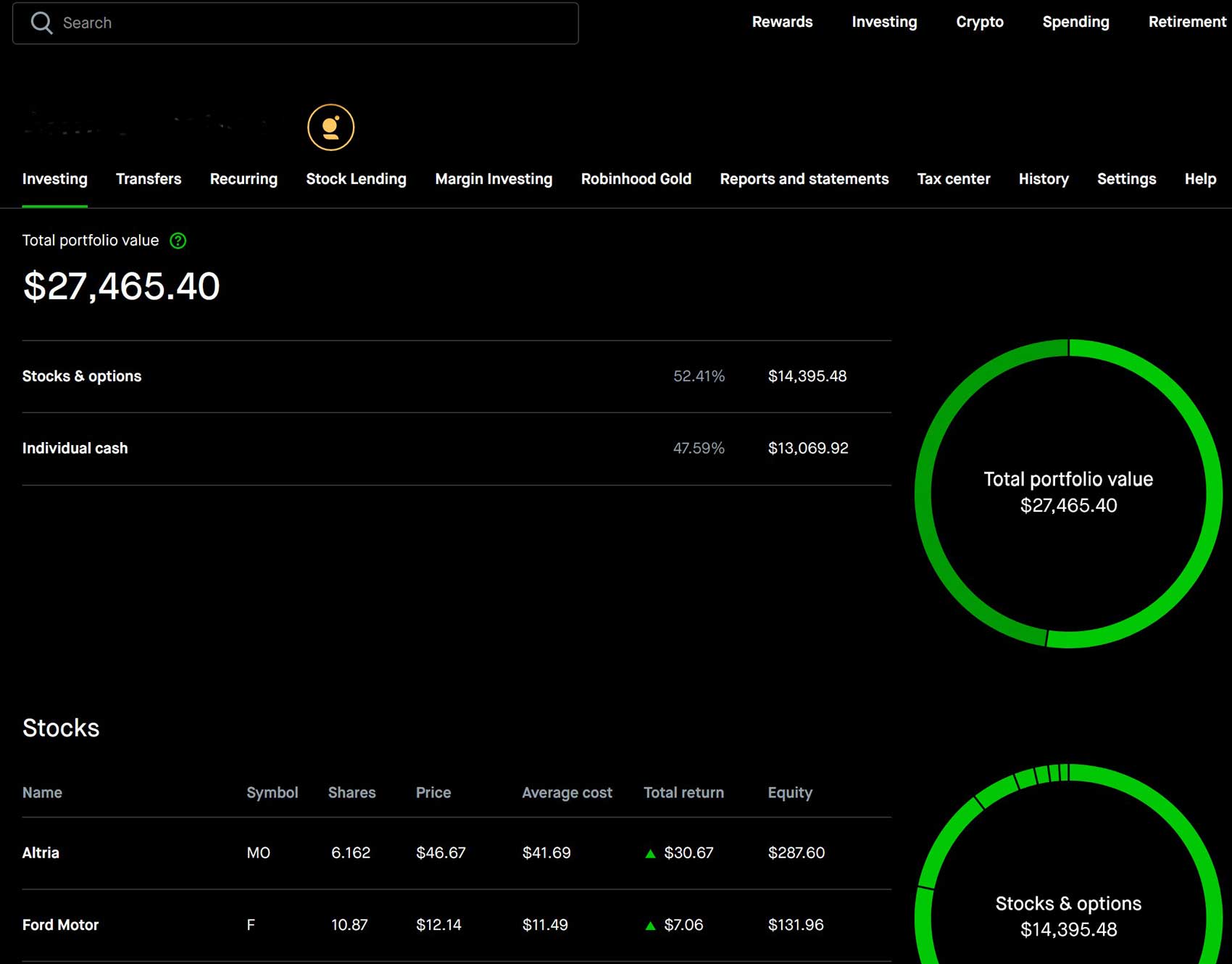

Robinhood disrupted the brokerage industry by offering free stock and ETF trades. That’s right, the company charges $0 for every stock and ETF transaction, with no limits on the number of trades customers can make.

The broker makes money on uninvested cash and by charging clients for other services, such as margin rates, trade confirmations ($2 each), and printed statements ($5 each). Regulatory and exchange fees for sales are also passed onto the trader, though these charges are minimal.

Robinhood has no monthly or annual fees, no surcharges for low balances or inactivity, and no minimum deposit to open an account.

WellsTrade also charges $0 for stock and ETF trades, with option contracts costing $0.65 each. Bonds, which Robinhood doesn’t offer, are priced on a markdown/markup basis. U.S. Treasury fixed-income securities incur a $50 charge per order.

Like Robinhood, WellsTrade has no minimum deposit requirement. The broker does charge a $30 annual fee per household, which can be waived by opting for e-delivery of account documents. Tax statements are exempt from this fee.

Robinhood wins this category.

Mutual Funds and ETFs

Robinhood does not offer mutual funds at any price.

WellsTrade offers mutual funds, with nearly 10,000 available through its screener. Over 2,500 of these funds come with no transaction fee and no load. Some of these are Wells Fargo funds. Non-NTF funds incur a $35 transaction fee. WellsTrade does not charge a short-term redemption fee.

ETFs are available at both brokers and can be traded for free.

The lack of mutual funds at Robinhood is a significant drawback, making this category a win for WellsTrade.

Cash Management

Wells Fargo, WellsTrade’s parent company, is a large financial institution, but its cash management features are not exceptional. A brokerage account doesn’t include any cash management features by default. Adding checkwriting privileges and a debit card costs $100 per year.

Robinhood pays 0.50% annual percentage yield (APY) on your cash. It also offers services like paycheck cashing, bill paying, and checking. Robinhood's Mastercard debit card is accepted at over 75,000 ATMs without fees.

Robinhood wins in this category.

Managed Accounts and Financial Advice

Investors seeking in-person financial advice or wanting someone to manage their assets can find support at one of Wells Fargo Advisors’ many locations across the U.S. There is an additional fee for this service, but it’s better than Robinhood, which offers no support in this area.

WellsTrade wins again.

Customer Support

WellsTrade offers 24/7 customer support by phone. The broker’s website has a messaging feature, though there’s no online chat.

Robinhood provides customer service only during weekdays during trading hours. The broker’s phone number isn’t toll-free, and the Robinhood mobile app has a messaging feature.

WellsTrade seems like the better option here.

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

WellsTrade:

Open a Wells Fargo investment account.

Wells Fargo vs Robinhood Summary

WellsTrade won five categories, while Robinhood succeeded in only two. WellsTrade is the clear winner. While Robinhood offers free equity trades, it lacks in many other areas.

|

Open Account

|

Open Account

Updated on 8/23/2024.

|