Overview

Investors looking for value in brokerage services might consider Wells Fargo and Fidelity Investments. Both firms offer a wide range of financial resources beyond investing. This article compares the two brokers to see which one might be the better choice.

Trading Tools

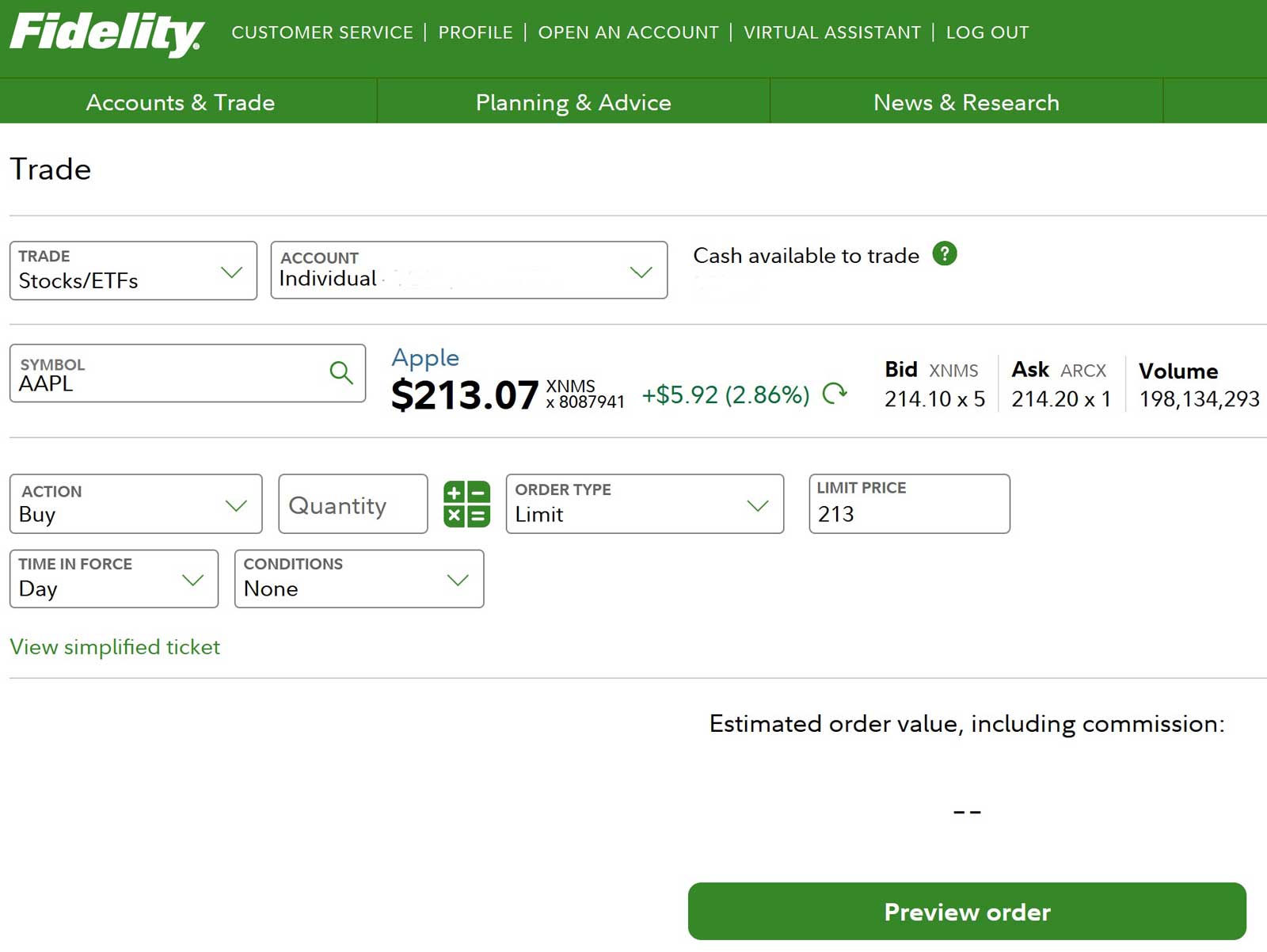

Fidelity customers can trade on the broker's website using a simple trading ticket that appears in the browsing window. It is not located at the bottom of the browser. After clicking 'Trade' on a security's profile page, the trading ticket appears on the left side of the screen. Customers also have access to good charting tools, with graphs that can be displayed full screen. There are over 20 technical indicators and a few drawing tools, allowing users to compare a security's price history with a stock or index. Fidelity also offers an advanced platform called Active Trader Pro, which comes with frequent trader requirements. Additionally, Fidelity is one of the few brokers with an app for Apple TV.

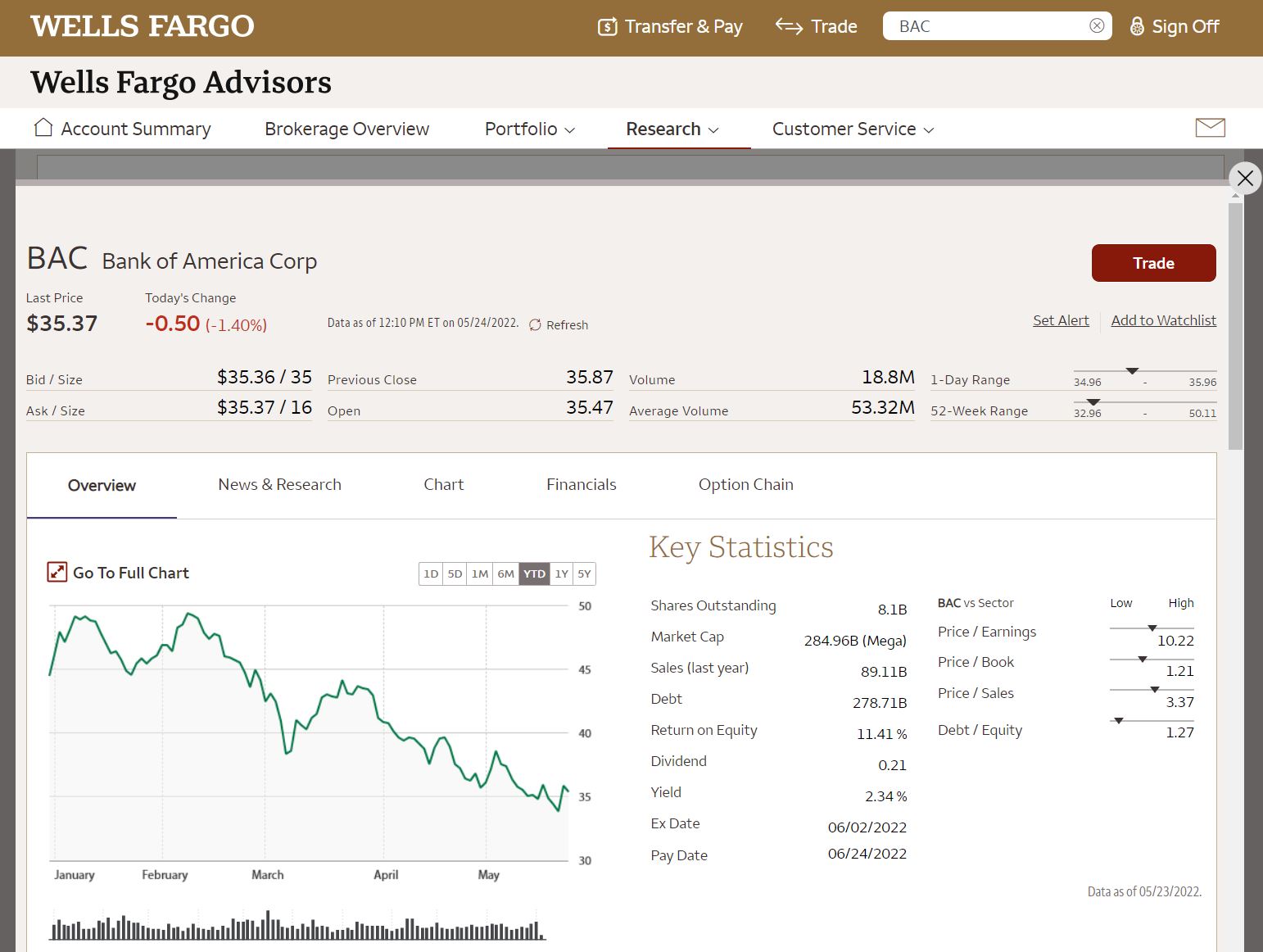

Wells Fargo's website does not have a trade bar. Interactive charting is available, offering more technical indicators and style options for price action display than Fidelity's software. However, the graphs cannot be displayed full screen, and the broker does not provide an advanced platform. There is a portfolio analyzer on the WellsTrade site, which appears to be a basic attempt at a desktop platform, but trades cannot be entered on it.

Fidelity wins this category.

Mobile Trading

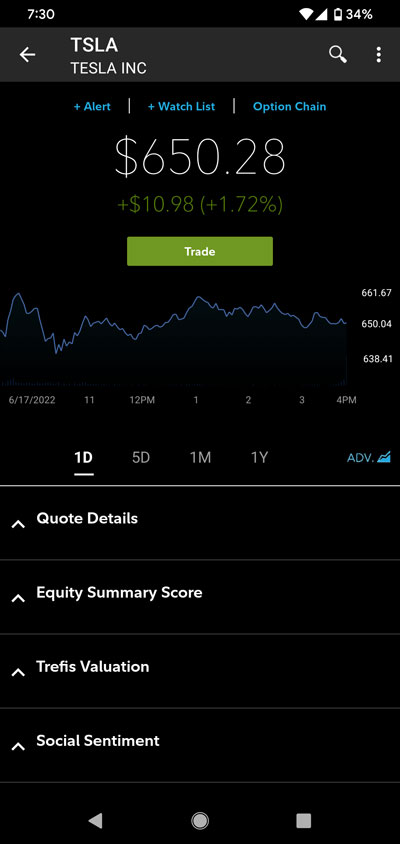

Fidelity customers who prefer mobile trading can use the broker's app, available for Android, Apple, and Windows Phone. There is also a platform for Apple Watch. The app allows users to transfer funds, pay bills, place trades, and contact customer service. Fidelity’s app also streams Bloomberg financial news in HD at no charge.

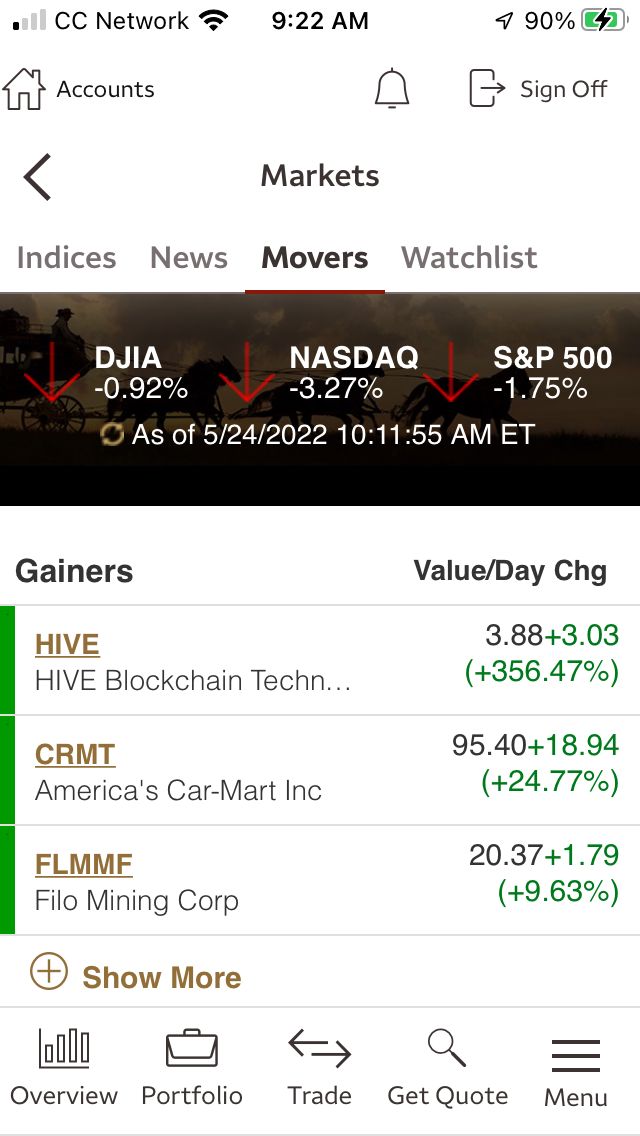

WellsTrade also offers a mobile app for Apple, Android, and Windows Mobile. The iPhone app can be somewhat slow to load pages. The platform provides market news, up-to-date account information, check deposit, and a watchlist. Simple charting is available, but it lacks technical studies, comparisons, or events, and there is no video news.

Fidelity wins this category for its free live streaming of business news.

Research and Education

Fidelity offers a robust library of research and educational materials on its website. Stock reports are available at no cost, and the firm maintains a collection of webinars, videos, and articles covering a variety of investment topics.

While Fidelity has a stock screener, WellsTrade does not. However, WellsTrade provides many articles by Wells Fargo in PDF format, covering market news and stock analysis. A stock's profile page also displays recent upgrades and downgrades from equity analysts.

Fidelity wins this category.

Commissions and Account Requirements

WellsTrade charges $0 for stock and ETF trades. Option contracts cost $0.65 per contract. Using a human representative to make a trade over the phone costs an extra $25.

Fidelity also charges $0 for ETF and stock transactions, with options priced at $0.65 per contract. A $25 fee applies for trades executed over the phone with a live agent.

WellsTrade has a $0 minimum deposit to open an account, while Fidelity requires a $0 minimum. Neither firm charges ongoing maintenance, inactivity, or annual account fees.

This category is a draw.

Fund Trading

Fidelity offers access to more than 11,500 mutual funds, with approximately 1,800 of these carrying no transaction fee and no load. WellsTrade offers slightly more than 10,000 mutual funds, with roughly 2,600 being no-load, no-transaction-fee products.

WellsTrade wins this category.

Customer Service

Fidelity provides customer support by email or phone 24/7, and also offers online chat. The firm has 180 locations across the U.S. for in-person service.

WellsTrade offers phone support 24/7 but does not have online chat or a network of retail locations like Fidelity. However, they do offer investment advisors for a fee in several U.S. cities.

Fidelity wins this category.

Alternatives

Fidelity vs Wells Fargo Summary

Fidelity Investments wins most categories, while WellsTrade has room for improvement. However, WellsTrade might still be a good option for Wells Fargo Bank customers.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Updated on 8/23/2024.

|