Investments

Of the three, ComputerShare offers the most limited investment options. Investors can only buy and sell stock from companies enrolled with ComputerShare.

In other words, if ComputerShare is not the stock transfer agent for a company or if the company doesn't participate in a Direct Stock Purchase Plan (DSPP), you can't purchase shares in that company.

ComputerShare only offers a limited selection of stocks, and you can't invest in other asset classes like bonds, mutual funds, options, or crypto.

This makes ComputerShare suitable only for investors interested in a non-diversified portfolio of individual stocks, assuming those stocks are available under a DSPP.

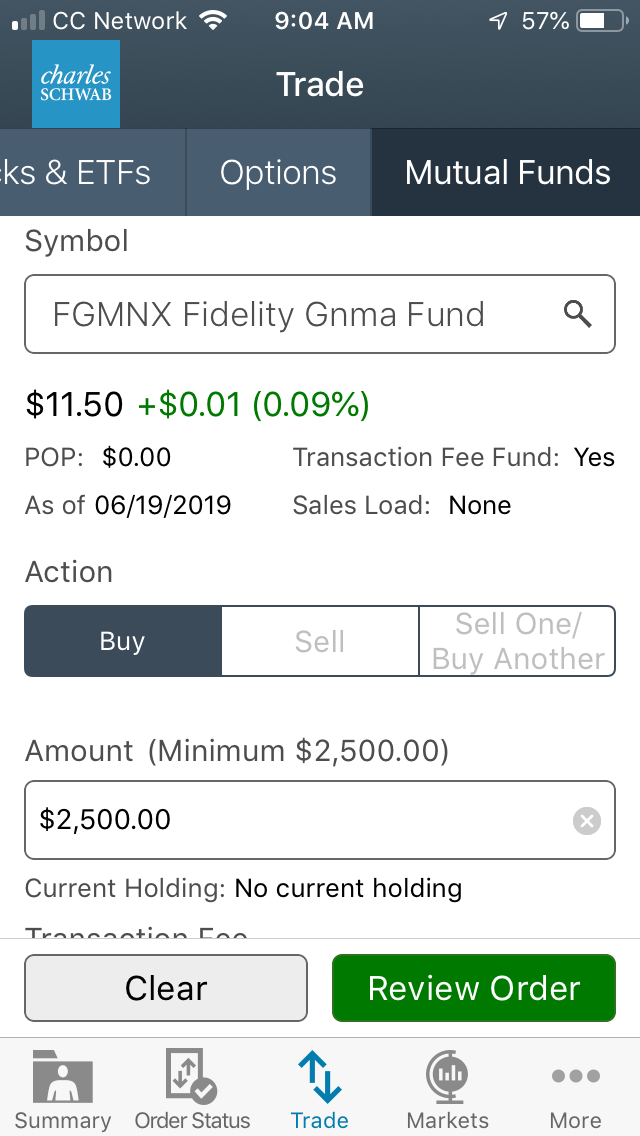

Charles Schwab provides a comprehensive range of investment options to meet the needs of both beginners and advanced investors. With Charles Schwab, you can trade:

- Stocks and ETFs, including over-the-counter (OTC) stocks, though these come with additional fees.

- Standard options contracts like puts and calls, with the platform supporting advanced strategies.

- Mutual funds.

- Fixed-income assets like bonds and certificates of deposit (CDs). These have high minimums, so newer investors might prefer fixed-income ETFs.

- Futures and FOREX through Charles Schwab Futures and Forex LLC. These are more suited to sophisticated investors, but Charles Schwab caters to all types of investors.

Charles Schwab doesn’t offer direct crypto investing, but you can invest in crypto-centered ETFs or Bitcoin futures. Schwab also doesn't allow fractional purchases, so initial stock buys must be in whole shares. Only reinvested dividends can buy fractional shares.

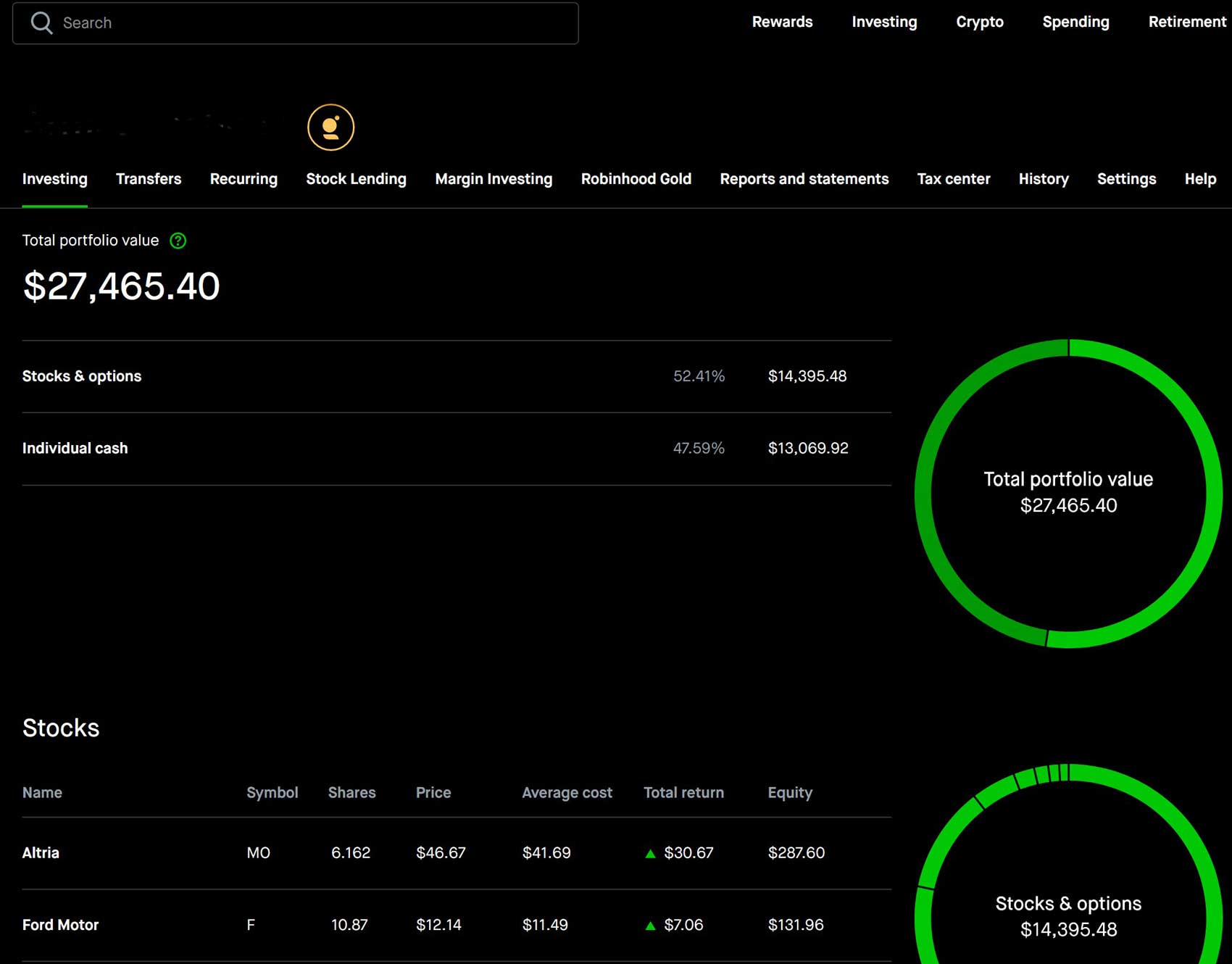

Robinhood sets itself apart by offering direct crypto investing options. From Robinhood’s main app, you can access a selection of popular coins that trade 24/7.

Robinhood also allows fractional share trading, options, OTC stocks, and some foreign stocks. The downside is that Robinhood doesn't offer many traditional investment options like mutual funds, bonds, or CDs.

Costs

ComputerShare is the least cost-effective option. Since ComputerShare acts as an intermediary between the investor and the company, rather than a brokerage, many fees are involved that today's brokerages don't charge.

The fee schedule is extensive, but typical fees include:

- $25 wire transfer fee for account funding.

- $50 annual service fee.

- $15 flat transaction fee for purchases, plus $0.03 per share.

- $25 per transaction when selling, plus $0.04 per share.

These fees make active trading with ComputerShare impractical, so it's best for high-net-worth individuals looking to buy and hold stock for the long term.

Charles Schwab has largely eliminated excessive fees. There are no minimums or account maintenance fees, and stocks/ETFs trade commission-free.

Some mutual funds may have additional costs depending on the fund manager, and options contracts incur a $0.65 fee per transaction. Schwab also charges a $75 fee to transfer your account to another brokerage.

Robinhood revolutionized commission-free trading, but now many brokerages offer similar fee structures. Robinhood users still enjoy commission-free trades, but the practice of payment for order flow (PFOF) has drawn criticism, especially during the Gamestop incident.

Today, Robinhood competes in other areas, like crypto offerings and app functionality. Robinhood offers a Gold tier for $5 a month, which includes Morningstar research reports, instant deposits, and a low 5% margin rate.

Open An Account

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Websites

ComputerShare’s website is functional but not particularly user-friendly. Registration is more complicated than with most brokerages, and the DSPP stock purchase process can be lengthy, though the site guides you through each step.

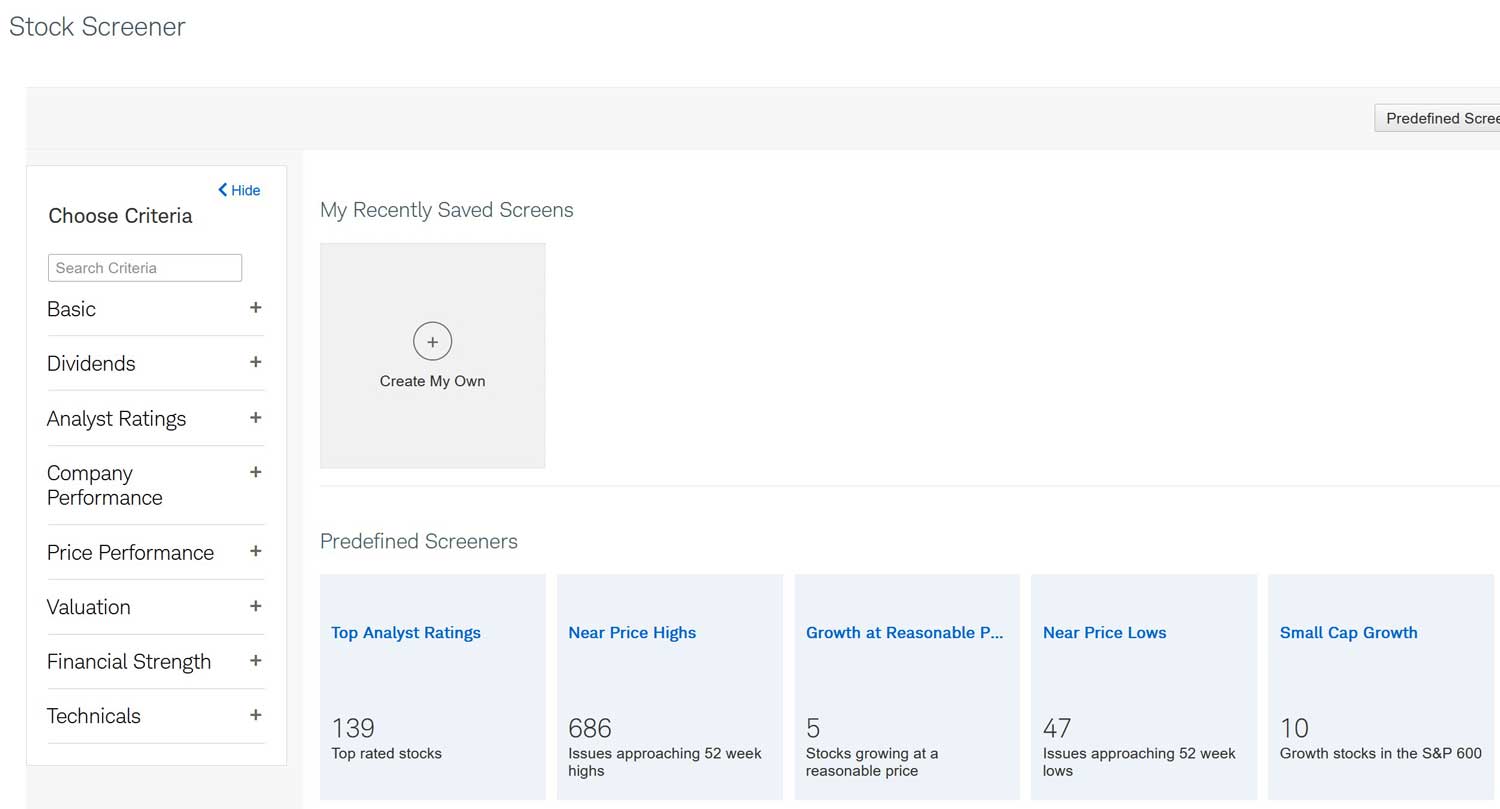

Charles Schwab’s website offers full investing and trading capabilities. Stock research is straightforward, with each company’s page providing in-depth analysis, including valuation, fundamentals, and analyst research. Schwab’s SnapTicket technology lets you buy or sell stocks directly from the company’s page.

Robinhood’s website mirrors its app-based design, offering all the same features in an accessible, easy-to-navigate format.

Mobile

ComputerShare does not offer a U.S.-based app. The only official ComputerShare Investor Centre app is available in Australia. Beware of unauthorized apps in the Google Play or Apple App Store, as they may be scams.

The Australian ComputerShare app only lets you monitor your account balance and portfolio holdings—it doesn't allow you to buy or sell stocks.

Charles Schwab’s app is practical and functional, allowing you to check your portfolio and trade stocks, ETFs, and options. However, mutual funds and other assets can only be traded on the main website. Building complex options strategies on the app can be tricky due to data lag.

Robinhood excels in mobile functionality. The app is intuitive and easy to navigate, making trading feel almost like a mobile game. Robinhood’s app is the best among these three, and the company’s focus on mobile accessibility sets it apart.

Robinhood’s app is especially noteworthy for options trading—you can price and trade options directly from the main stock page, saving time during volatile markets.

Additional Features

ComputerShare offers basic stock research resources, but they are not particularly useful for beginner or advanced investors. The information is basic, focusing on stock price and P/E ratio, with no analyst reports or in-depth analysis.

Charles Schwab offers valuable tools and resources for investors of all levels. In addition to research tools and analyst reports, Schwab offers the thinkorswim (ToS) platform, designed for active and advanced traders.

ToS offers advanced stock screening tools and technical indicators on the chart. You can quickly buy or sell stocks directly from the chart. ToS also has a mobile app, though it’s less functional than the desktop version.

The ToS platform may not be intuitive for new investors, but Schwab’s education center helps bridge the gap. The platform also has a “paper trading” mode, allowing you to practice strategies without risking real money.

Robinhood focuses on simplicity, and its additional resources reflect that. Robinhood offers some basic education and research tools, but they are limited. Robinhood Gold provides advanced analysis tools from Morningstar.

Open An Account

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Recommendations

Beginner

For new investors, Robinhood is an excellent entry into the market. Its intuitive interface makes buying and selling stocks simple. However, some argue that Robinhood’s ease of use can lead to poor financial decisions.

If you’re motivated to learn and prefer a more comprehensive portfolio, Charles Schwab is a better choice. While Schwab’s platform is less intuitive, its education center helps beginners get up to speed, and the added complexity can help protect your capital.

Advanced

Charles Schwab is the best option for advanced investors. Schwab offers asset classes that Robinhood and ComputerShare don’t, like fixed-income vehicles and mutual funds. The advanced options strategy builder and thinkorswim platform make Schwab a top choice for experienced traders.

ComputerShare is suitable for advanced investors who want to buy and hold stock for a long time, but it’s not the best option.

IRA

Charles Schwab is the only full-spectrum IRA provider among these three, and it would be the best option regardless. Schwab optimizes the IRA investing experience and makes it easy to manage alongside a standard investment account.

Conclusion

Overall, Charles Schwab is the clear winner. Robinhood is great for learning to trade, but anyone interested in a more comprehensive experience will outgrow it. Charles Schwab is a platform that can serve investors for life.

ComputerShare has its merits, but its high fees and limited features make it a niche option for a select group of investors. If you’re not planning to buy and hold large quantities of individual stocks for decades, ComputerShare is not the best choice. Charles Schwab fills the gap for both advanced investors and those seeking more active management than ComputerShare offers.

Open Charles Schwab Account

Open Schwab Account

Updated on 8/23/2024.

|