Robinhood Iron Condor or Butterfly Spreads (2024)

Robinhood options spreads trading. Can I buy Straddle, Strangle,

Vertical Butterfly, Condor, Iron Butterfly, Iron Condor and Calendar.

|

Robinhood Options Spreads

Robinhood is well-known for its no-commission approach to investing. The firm was the first to

offer free trading and maintains this value-oriented approach. One stand-out feature is the

commission-free options spread trading.

No matter which securities you trade at Robinhood, be it stocks, ETFs, or a combination of the two, option spreads provide additional control over your portfolio.

Robinhood provides traders with access to many advanced options spread strategies. You can easily create spreads that help you benefit from various market conditions. Spreads make it possible to take advantage of prices going up, down, and even sideways.

Keep reading to learn more about options spread trading at Robinhood.

Options Trading Permissions at Robinhood

To trade options spreads at Robinhood, you must be approved for Level 3 Options Permission. As Robinhood’s highest options trading level, Level 3 allows traders to utilize the broker’s most advanced options spreads.

Types of Options Spreads Available at Robinhood

You’ll be able to find an option spread at Robinhood to match whichever strategy you have in mind. Selling spreads for a credit, capping and defining risk with debit spreads, profiting from theta decay, or going for an outsized payout with a precise price prediction are all possible.

Here are the spreads you can trade with Robinhood:

- Debit Spreads

- Credit Spreads

- Iron Condors

- Iron Butterflies

- Broken Wing Butterflies

- Unbalanced Butterflies

- Calendar Spreads

- Diagonals

- Butterflies

Robinhood Promotion

Open Robinhood Account

How to Place Options Spread Orders on Robinhood

Placing an option spread trade at Robinhood is easy, but there are some details to the process that investors should know.

The main thing to remember is that you will need to know how your desired spread is constructed. Robinhood does not offer a spread selection menu as many other brokers do. Instead, advanced options positions are created by selecting individual legs.

Here’s how to do it.

Option Spreads Building Blocks

To begin building spreads, it is good to know the mechanics of Robinhood’s options chains and order format.

As with all things Robinhood, simplicity is at the heart of the options trading layout. You can choose between buying and selling, as well as calls and puts. You can also select the expiration date for each of the legs of your spread.

With Robinhood’s spread ‘building blocks (our term),’ you can build virtually any options spread you want.

Setting Up an Option Spread

To set up an option spread at Robinhood, you can use the ‘building blocks’ in a variety of ways. You can combine long and short calls and puts to create spreads of varying complexity.

To get started, navigate to the options chain of your preferred stock or ETF.

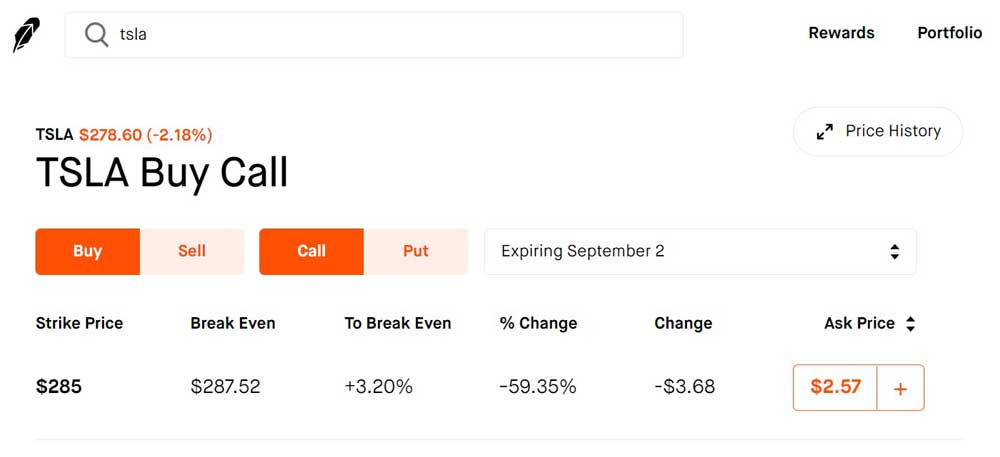

You’ll begin the option contract selection process from the options chain. For our example, we will build a debit spread with a same-week expiration. We want to profit if the price of the stock moves down.

The current price of our example stock is $280, and we think the price will go to $250 by the end of the week. For this premise, we are using a put debit spread. We will buy the spread for a debit and profit if the price moves in our favor.

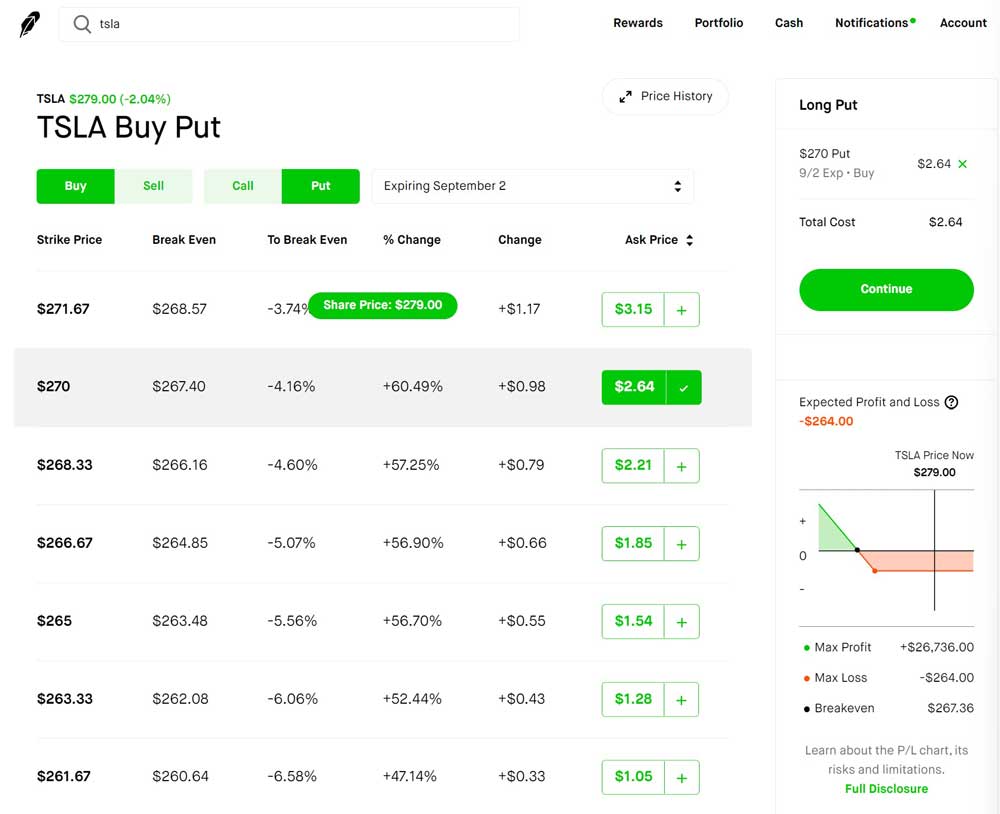

Begin by selecting a long put. Your long put can be in, at, or out of the money. The risk/reward will change based on your choice. We are choosing an out-of-the-money long put to reduce cost and risk.

Notice the PnL calculator for the single option and the price.

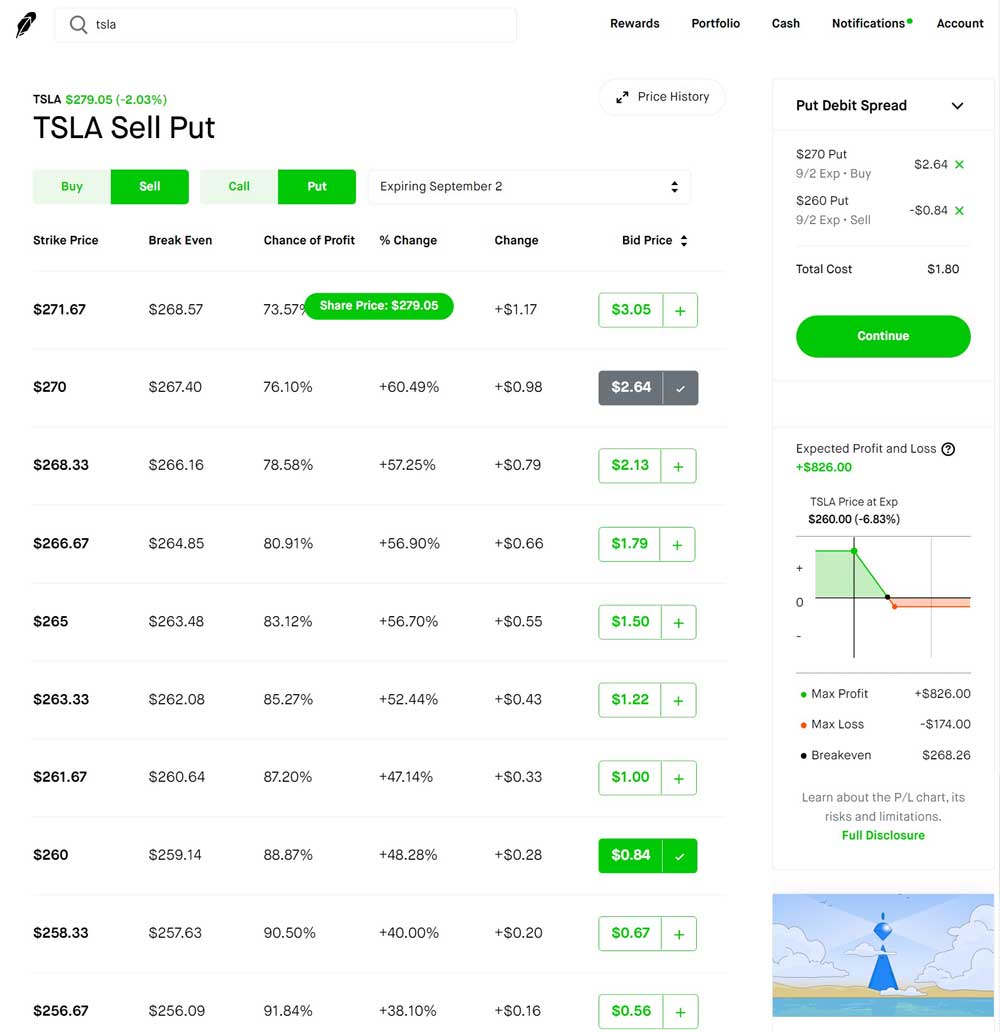

Next, select a short put that is further out of the money. The distance that you choose will define the amount of profit you can make from your spread. We are selecting an option that is $10 below ($1000 – debit paid for the spread if the entire profit is attained).

Again, look at the expected PnL graphic and the updated price.

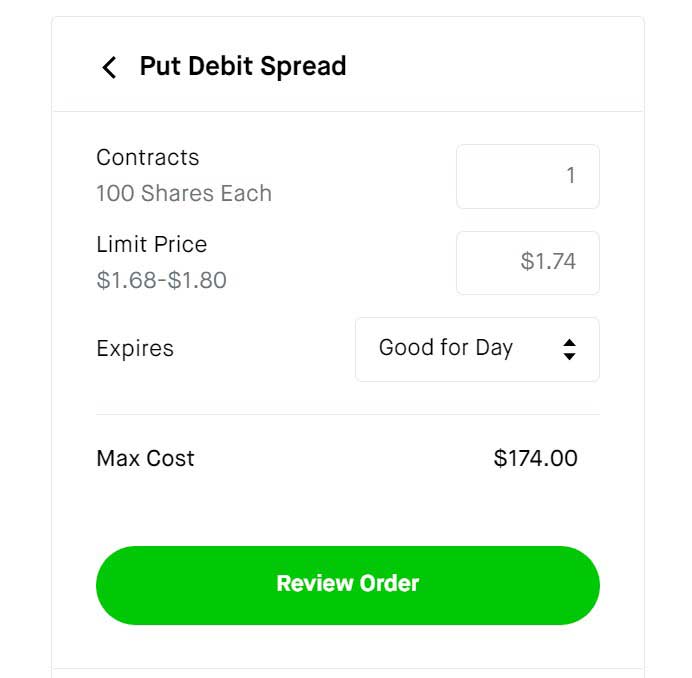

Once you have built your desired spread, you can decide on the number of contracts you want to purchase, your preferred price, and the Time in Force.

Options Trading Margin Requirements

To trade options spreads at Robinhood, you do not need to maintain a large amount of capital in your account. As long as you have Level 3 options trading permission enabled, you can trade spreads at your heart’s content.

It is also good to know that you can enable Level 3 options trading in the Instant Account (basic margin account) and Robinhood Gold.

Fees and Commissions

It is good to remember that Robinhood has a zero-commission approach to options trading. That means putting complex spreads on will not come at a high cost. Robinhood is one of only a few brokers that offer such a good deal on options, and it is undoubtedly one of the advantages enjoyed by active options traders.

Robinhood Options Spread Trading Pros and Cons

Options spread trading at Robinhood comes with pros and cons.

Pros

- Creating spreads is easy to do at Robinhood

- There are no account minimums to meet to get started

- Robinhood’s theoretical PnL graph makes it easy to ‘see’ how a position may perform

- Good selection of spreads to choose from

Cons

- Robinhood does not show the expected Market Maker Move (MMM) for options

- Fills for ‘custom’ spreads can be a bit slow to fill

- You must know how your desired spreads are built as Robinhood does not automate the process

|