|

JP Morgan Chase vs Moomoo (2024)

JP Morgan Chase vs Moomoo—which is better? Compare investing accounts,

online trading fees, stock broker extended hours, and differences.

|

J.P. Morgan Investing vs. Moomoo Introduction

J.P. Morgan Investing is backed by a well-established financial giant, while Moomoo is a newer brokerage aiming to revolutionize investing. Which one is the better choice? Let’s find out:

Cost Comparison

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Chase

|

|

|

|

|

|

|

|

Moomoo

|

|

|

|

|

|

|

Promotions

J.P. Morgan Chase:

Get $0 stock commissions at J.P. Morgan.

Moomoo:

Get zero commissions at Moomoo.

Investment Options: J.P. Morgan Investing Takes the Lead

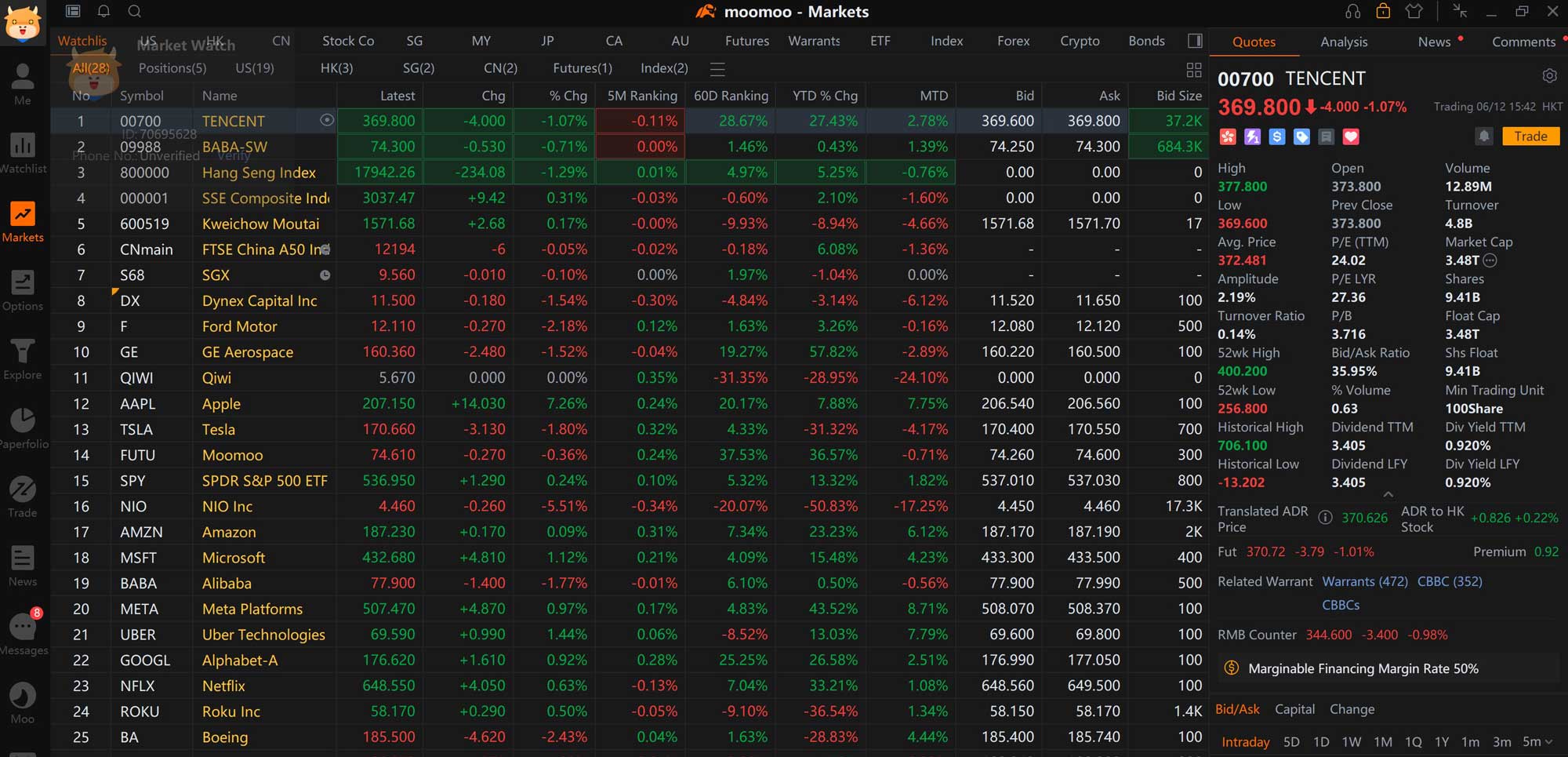

Moomoo clients can trade the following assets:

- U.S. and Chinese stocks

- ADRs

- Options

- ETFs

- Closed-end Funds

These investments are available only in individual taxable accounts.

J.P. Morgan Self-Directed Investing offers both joint and individual accounts with access to:

- U.S. stocks

- ADRs

- Options

- Mutual funds

- ETFs

- Closed-end funds

- Fixed-income securities

PC Software: Moomoo Comes Out on Top

J.P. Morgan Investing operates through the Chase Bank website, which includes basic trading tools like:

- Trade ticket with four order types

- Basic charting (no full-screen mode)

- Watchlist without alerts

Moomoo’s website mainly serves to advertise its services, with recent additions of educational articles, a stock screener, and asset profiles. However, trading is only available through Moomoo’s desktop platform, which can be downloaded from the website.

Moomoo’s desktop software offers advanced features such as full-screen charting, a right-click menu, a screenshot button, watchlists, alerts, and a trade ticket with 12 order types.

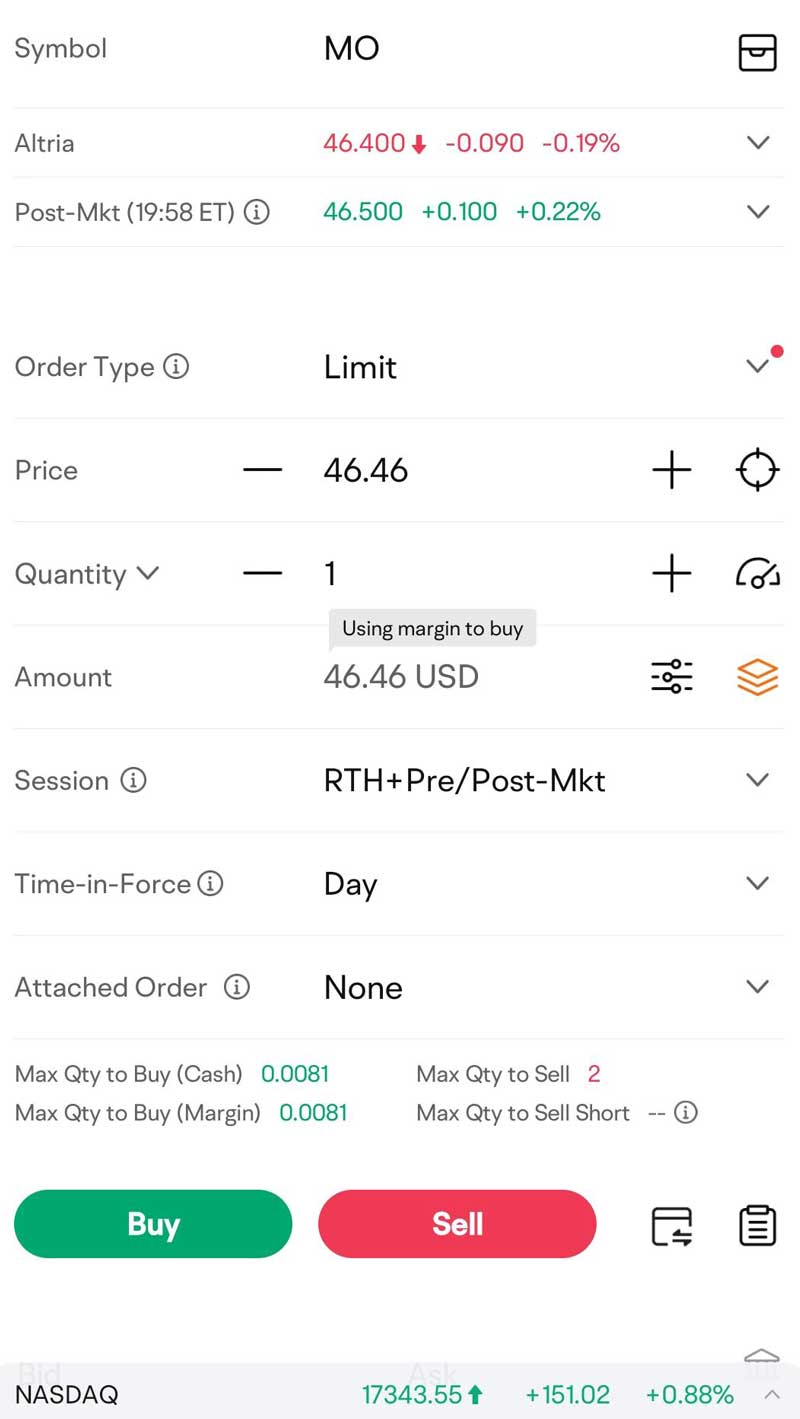

Mobile Apps: Moomoo Leads Again

Moomoo’s mobile app is packed with features, including free stock promotions for referrals, an elite member program, news articles, and a learning center. Trading tools include:

- Simulated trading system

- Watchlists that sync with the desktop platform

- Order ticket with eight trade types

- Horizontal charting with several tools

J.P. Morgan Investing’s app, which is part of the Chase Bank app, offers fewer trading features but still includes:

- Vertical charting with some tools

- Order ticket with four order types

- Separate tickets for options and mutual funds

- Chains for calls and puts

- Multiple watchlists that sync with the website

Margin Trading: Moomoo Takes the Lead

J.P. Morgan Investing doesn’t offer margin trading, but Moomoo does. In fact, Moomoo only offers margin accounts with a flat rate of 6.8 for long positions. The rate for short positions varies by security and day.

Miscellaneous Services: J.P. Morgan Investing Has an Edge

Extended Hours Trading: Moomoo offers pre-market and after-hours trading. J.P. Morgan Investing does not.

Periodic Mutual Fund Investing: Available only with J.P. Morgan Self-Directed Investing.

Individual Retirement Accounts: Available only with J.P. Morgan Investing.

Banking Tools: Only J.P. Morgan Investing provides checks and debit cards.

DRIP Service: J.P. Morgan Self-Directed Investing allows dividends to be reinvested into additional shares.

Fractional Shares: Not available at either firm.

Initial Public Offerings: Moomoo offers an IPO Center on its mobile app and desktop platform. J.P. Morgan Investing does not offer this service.

Our Recommendations

ETF/Stock Trading: Moomoo’s advanced desktop software and mobile app make it the clear choice.

Small Accounts: J.P. Morgan Automated Investing requires a $500 minimum deposit, but neither broker has minimums or fees for self-directed accounts.

Long-Term Investors & Retirement Savers: J.P. Morgan offers retirement accounts and target-date mutual funds, while Moomoo does not.

Mutual Fund Trading: J.P. Morgan Self-Directed Investing offers over 3,000 no-fee funds.

Beginners: Moomoo’s platform is powerful but not beginner-friendly, and its customer service and educational resources are limited.

Moomoo vs. J.P. Morgan Summary

Moomoo is the better choice for advanced equity traders, while J.P. Morgan Investing is better suited for long-term investors and financial planning.

|

Open Account

|

Open Account

Updated on 8/23/2024.

|