Edward Jones vs Vanguard Introduction

Which brokerage firm offers the trading tools you need, Webull, Edward Jones, or Vanguard? Webull boasts an

excellent desktop program, Vanguard is renowned for its investment-advisory services and extensive

mutual fund selection, and Edward Jones is known as the largest and best-known wealth management company in the country.

Here's a detailed comparison of these three brokers:

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

WeBull

|

$0

|

na

|

$0

|

$0

|

$0

|

|

Vanguard

|

$0

|

$20

|

$1.00 per contract

|

$20*

|

varies

|

Edward Jones is the most expensive of the three, which is its main disadvantage. It charges $3.95 per trade, 2.5% for advisory services, and additional fees elsewhere, ensuring significant revenue for its services. Clients should be fully aware of these costs as they can impact long-term investment returns.

Management Fees

First $250,000: 1.35%

Next $250,000: 1.30%

Next $500,000: 1.25%

Next $1,500,000: 1.00%

Next $2,500,000: 0.80%

Next $5,000,000: 0.60%

Next $10,000,000: 0.50%

Portfolio Strategy Fees

First $250,000: 0.09%

Next $250,000: 0.09%

Next $500,000: 0.08%

Next $1,500,000: 0.07%

Next $2,500,000: 0.06%

Next $5,000,000: 0.05%

Next $10,000,000: 0.0%

Trade Commissions

Up to $5,999.99: 2.50% (max fee: $150)

$6,000 to $9,999.99: 2.00% + $30 (max fee: $230)

$10,000 to $24,999.99: 1.50% + $80 (max fee: $455)

$25,000 to $99,999.99: 1% + $205 (max fee: $1,205)

$100,000 and above: 0.50% + $705 (no max fee)

Services

Promotions

Webull:

Get up to 40 free stocks when you deposit money at Webull!

Vanguard:

Open a Vanguard investment account.

Edward Jones: none right now.

First Category: Tradable Assets

If you open a brokerage account at Vanguard, you’ll have access to these securities:

- Bonds and CDs

- Equities (including the OTC marketplace)

- Option contracts

- Mutual, closed-end, and exchange-traded funds

Webull offers a narrower range but includes cryptocurrencies. Current offerings include:

Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), Pepe Coin (PEPE), Stella Lumens (XLM), Ethereum Classic (ETC), Cardano (ADA), Polkadot (DOT), Shiba Inu (SHIB), Basic Attention Token (BAT), Chainlink (LINK), Uniswap Protocol Token (UNI), Algorand (ALGO), Polygon (MATIC), Sushi (SUSHI), Avalanche (AVAX), REN (REN), Solana (SOL), Cosmos (ATOM), Decentraland (MANA), Fantom (FTM), The Graph (GRT), CurveDAO Token (CRV), Loopring (LRC), Tezos(XTZ), USD Coin (USDC), Aave (AAVE), Crypto.com Coin (CRO), yearn.finance (YFI), Apecoin (APE), Chiliz (CHZ), Synthetix(SNX), Gala (GALA), BNTUSD (BNT), COMPUSD (COMP), ENJUSD (ENJ), Maker (MKR), FILUSD (FIL), and ICPUSD (ICP)

Edward Jones provides a broad array of products, including:

- Annuities: Variable, Fixed, Immediate

- Employer Retirement Plans: Defined Contribution, Defined Benefit

- Education Savings: 529 Plans

- Equity Investments: Common Stocks

- Exchange-traded Funds

- Fixed-income Investments: Bonds, Corporate Debt Securities

- Individual Retirement Accounts (IRAs): Roth IRAs, Traditional IRAs

Winner: Vanguard

Second Category: Websites

Navigating the Vanguard website can sometimes be challenging. If you open an account with Vanguard, you'll need to familiarize yourself with it, as they don't offer a browser-based trading platform. A search field in the upper-right corner helps make finding information easier.

On a security's profile page on Vanguard, you'll encounter their charting tools. These tools lack a full-screen view but offer various graph styles and some technical indicators. Corporate events are also displayed, but there are no drawing tools available. The trading interface supports market, limit, stop, and stop limit orders.

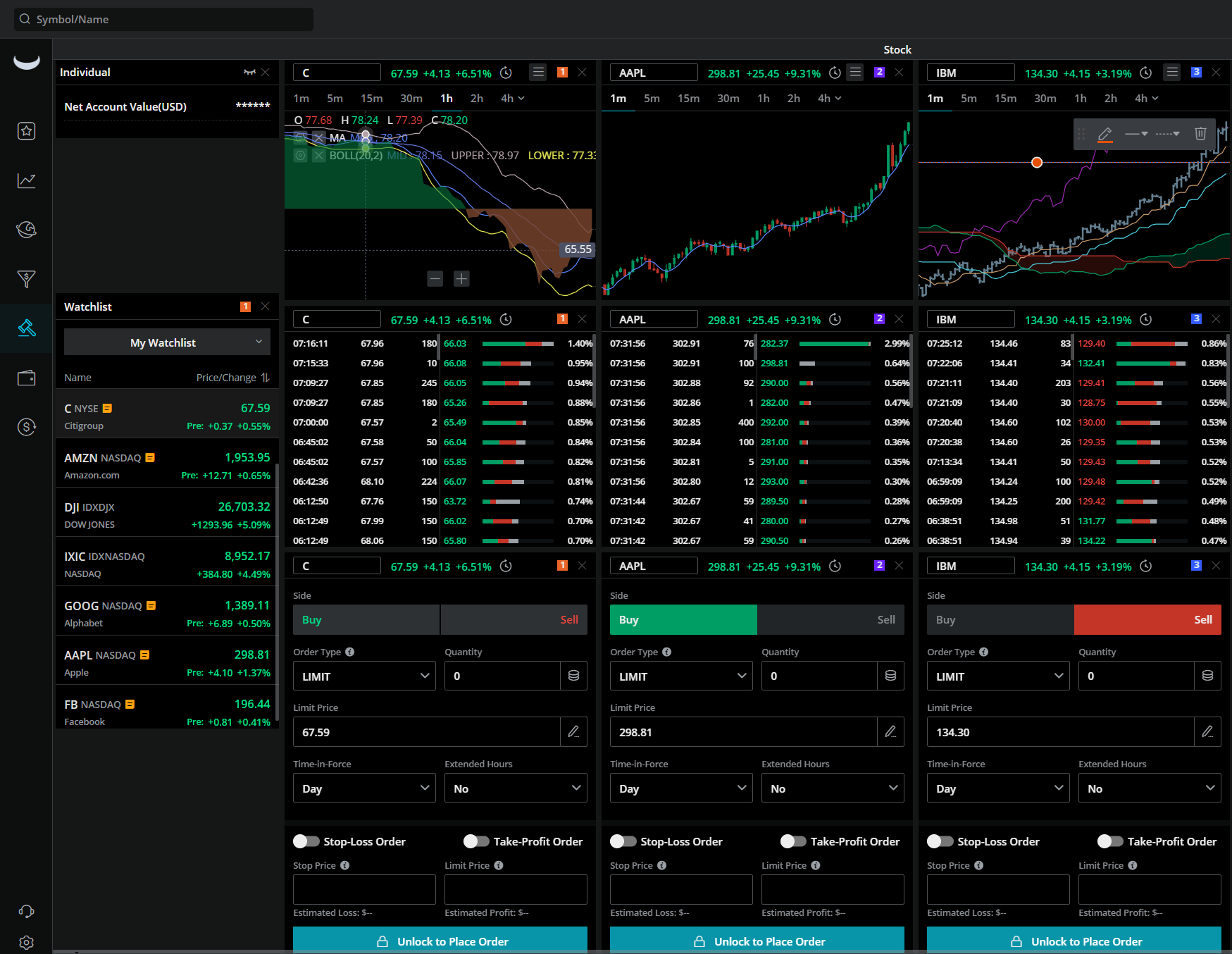

Webull's website is minimalist, mainly offering essential account management tools such as fund transfers. However, it has a comprehensive browser platform accessible directly from the site, packed with impressive features.

Webull's trading interface includes the same order types as Vanguard's plus trailing and bracket orders, which can be easily toggled on and off.

Webull’s charting capabilities on its browser platform include a full-screen mode and more graph styles, such as Heikin Ashi and Base Line. Right-click trading enhances the user experience significantly over Vanguard’s offerings.

Edward Jones's technology tools are limited, especially if you have a financial advisor. Their charting tools are basic, mainly for display purposes. The mobile app mirrors the simplicity of their website, offering a straightforward interface that appeals to investors who prefer a hands-off approach. Over 8 million clients have chosen Edward Jones for this user-friendly design.

Winner: Webull

Third Category: Desktop Platforms

Webull offers a desktop application for those who prefer not to use its browser platform. This software shares many features with the browser version but allows for customized layouts and managing trades outside a web browser.

A limitation of Webull's desktop platform is that it does not support cryptocurrency trading, which its browser platform does.

Vanguard does not offer any desktop trading platform.

Winner: Webull

Fourth Category: Mobile Apps

Surprisingly, Webull's mobile app offers even more advanced charting features than its desktop or browser platforms. It includes a unique replay feature that shows the previous day's market activity with associated sales data, which can be sped up or slowed down.

Additionally, Webull's app hosts a social networking forum and offers trading competitions in a practice mode.

Vanguard’s app allows for mobile check deposits and trading Vanguard mutual funds but lacks advanced charting capabilities. The app provides only basic graphs for market indexes and has a less user-friendly order interface with fewer options.

Winner: Webull

Fifth Category: Investment Education

Vanguard offers a wealth of educational resources, including over 200 instructional videos on its YouTube channel, covering a broad range of financial topics. You can also find numerous articles on investing and personal finance on their website, accessible through the News & Perspectives section. Topics are varied and include retirement planning and financial management, supplemented with podcasts and videos.

Webull provides basic FAQs on its website but lacks the extensive educational content that Vanguard offers.

Edward Jones focuses heavily on investor education, offering a wide array of articles and resources on their website, covering everything from market trends to personal well-being.

Winner: Edward Jones

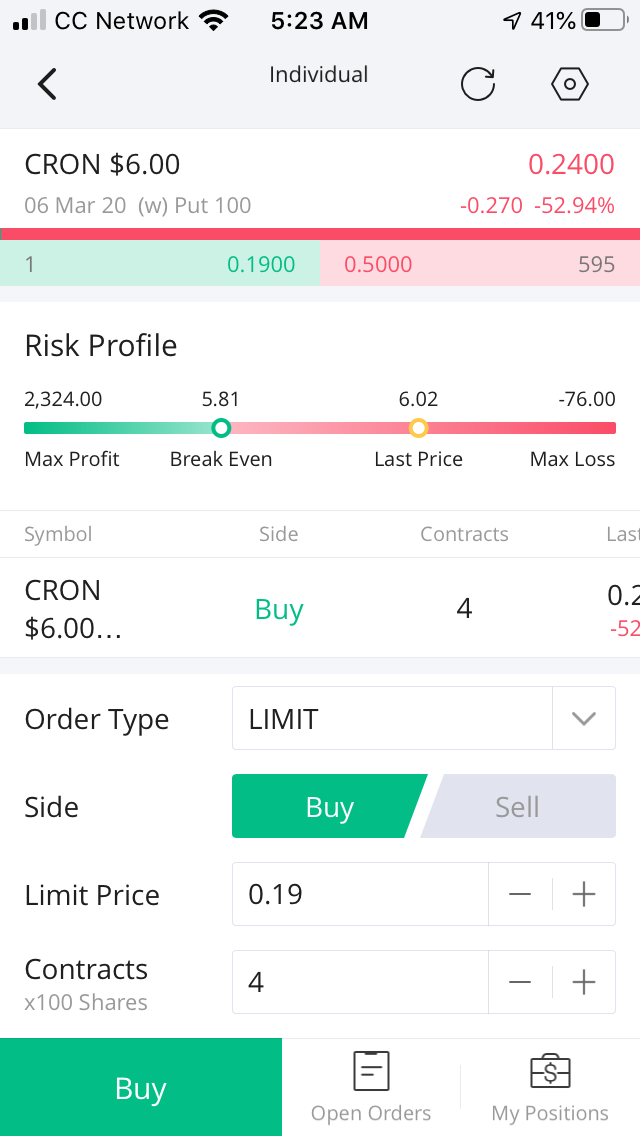

Sixth Category: Options Trading

If you're interested in trading options, both Vanguard and Webull provide the necessary tools. Webull’s mobile and desktop platforms have a user-friendly interface where you can easily adjust option contracts, set buy or sell orders, and see potential profits or losses. However, you can only place simple single-option orders.

Vanguard offers basic options trading like calls and puts without the complex details found in Webull's offerings.

Winner: Webull

Seventh Category: Margin Borrowing

Both Webull and Vanguard offer margin accounts, allowing you to borrow money to trade. Vanguard's interest rates vary from

9.25% to 13%.

Webull not only offers lower interest rates but also provides detailed margin information on its platforms, including how much you can borrow and the maintenance requirements. Webull's rates range from 6.24% to 9.24%.

Winner: Webull

Eighth Category: Miscellaneous Services

Dividend Reinvestment Program (DRIP): Vanguard offers a DRIP service, but Webull does not.

IRAs: All three firms offer Roth and Traditional IRAs, but only Vanguard and Edward Jones offer SEP and SIMPLE IRAs as well.

Fractional-share Trading: Webull allows trading of fractional shares, whereas Vanguard and Edward Jones do not.

IPO availability: Webull provides access to Initial Public Offerings. You can find these under the IPO section in the app.

Extended hours: Webull supports trading both before the market opens and after it closes. Vanguard only offers after-hours trading, and Edward Jones does not offer extended trading hours at all.

Automatic Mutual Fund Investing: Vanguard allows automatic investments into its mutual funds.

Winner: Webull

At Last, Our Recommendations

Beginners: Vanguard is recommended for beginners because of its automated investment service and extensive educational resources that are more comprehensive than Webull’s.

Long-Term Investors and Retirement Savers: Vanguard is the top choice for long-term investing and retirement planning, offering specialized mutual funds and retirement accounts.

Stock/ETF Trading: Webull is the preferred platform for trading stocks and ETFs, featuring advanced tools and a flexible trading system.

Small Accounts: There are no ongoing fees or minimum balance requirements at either company.

Promotions

Webull:

Get up to 40 free stocks when you deposit money at Webull!

Vanguard:

Open a Vanguard investment account.

Edward Jones: none currently available.

Webull vs Vanguard vs Edward Jones Judgement

Overall, the competition between Webull and Vanguard is close. Active traders should opt for Webull, while Vanguard is better suited for those focused on long-term investments.

Updated on 7/4/2024.

|