Transfer Vanguard to Robinhood (and Vice Versa) in 2024

How to Transfer Accounts between Vanguard and Robinhood

Moving an investment account from Vanguard to Robinhood, or vice versa, is straightforward and quick, thanks to the Automated Customer Account Transfer Service (ACATS). Keep reading, and we’ll show you all the details you need to know.

Transfer from Vanguard to Robinhood

First, get your Vanguard account ready for the transfer. Since Robinhood only offers individual and Traditional/ROTH IRA accounts, your Vanguard account needs to be one of these types. If it isn’t, you can open a new individual account and transfer assets into it. Note that doing so may have tax implications, so consult a licensed tax professional before proceeding.

Option contracts in their expiration week should be closed out or left behind in a partial transfer. Robinhood won’t accept them. Some option strategies might not be supported by Robinhood either.

Bonds and mutual funds can’t be transferred because Robinhood doesn’t support trading in them.

Fractional shares of stocks and ETFs can’t be moved through the ACATS network. Vanguard will automatically convert them to cash, which can then be transferred. You can also sell them to handle the conversion yourself.

Robinhood does not allow short positions. If you have short positions in your Vanguard account, they’ll need to be covered before starting the transfer.

Second, you’ll need to

open a new Robinhood account

if you don’t have one. Make sure the name on it matches the name on the Vanguard account.

If you’re transferring options or a margin balance from Vanguard, the Robinhood account needs those features enabled. This includes the correct options level for spreads or other strategies that need an advanced level.

Third, fill out the ACATS form. Use the Robinhood mobile app or website for this.

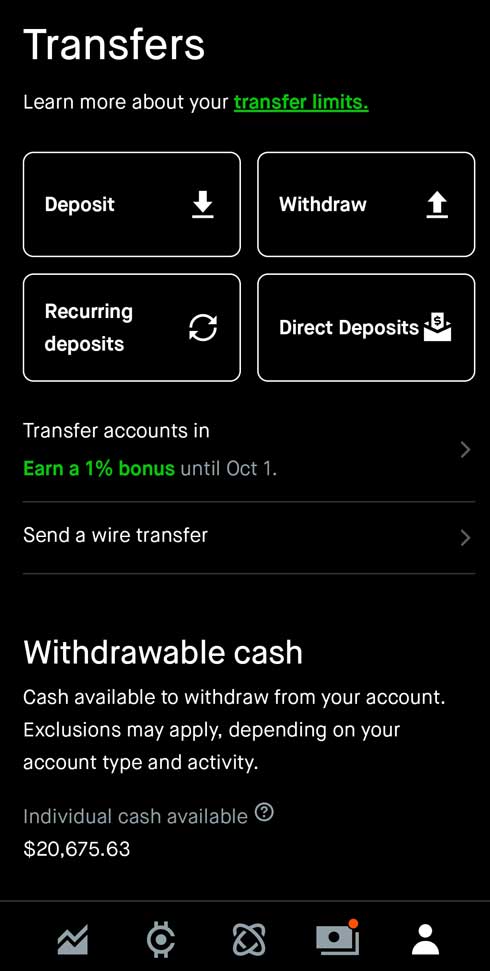

To find the form in the app, tap on the person icon at the bottom-right corner. Next, tap the settings icon (three horizontal bars) in the upper-left corner.

On the next page, tap on the Transfers link. Then tap on the link to transfer accounts into Robinhood. This will bring up the ACATS request form. Scroll through the list of firms until you see Vanguard’s logo. Tap it to pre-fill the outgoing broker and start the application. Enter the required account details, such as your Vanguard account number, and complete the application fields.

Fourth, monitor the transfer. You can track its progress on Robinhood’s website or mobile app. It should take about 5 to 7 business days to complete.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Transfer from Robinhood to Vanguard

To transfer a Robinhood account to Vanguard, just follow these steps:

First, get your Robinhood account ready for the transfer. This involves closing out any option contracts expiring in 5 days or less if you’re doing a full transfer. For a partial transfer, you can leave them behind.

Cryptocurrencies also can’t be transferred. If you try to move these out of your Robinhood account, they might be sold off. To avoid this, you can transfer the digital currencies internally from one Robinhood account to another and then do a full transfer from the account without cryptocurrencies. The same goes for option contracts.

Although Robinhood doesn’t offer trading for most over-the-counter stocks, it does support a few. Keep in mind that Vanguard no longer allows trading in most OTC stocks, so any OTC stocks at Robinhood probably won’t transfer.

If your Robinhood account has a negative cash balance, you’ll need to clear it before proceeding.

Second, open a Vanguard account if you don’t have one yet. In an ACATS transfer, assets are moved from one brokerage account to another, but the accounts themselves don’t move. A full account transfer will close the outgoing account, while a partial transfer will leave it open.

If you already have a Vanguard account, it may be able to receive assets from Robinhood. The names on the two accounts must match exactly, and both accounts must be of the same type (e.g., both must be individual accounts). If either condition isn’t met, it’s easy to open a new Vanguard account. Look for the link to open a new account in the upper-right corner of the website. You’ll have the option to open a new account or open a new account and transfer assets from an external account at the same time. While the second option sounds perfect, it’s also possible to open the account and do the transfer later.

Third, request the transfer. You can do this during the account application, as mentioned above. If you want to use an existing individual account at Vanguard, the ACATS form can be found by clicking on the "Open an account" link at the top of the site. On the next page, choose whether to open a new account or transfer an existing account from Robinhood.

Choosing the transfer option generates the form. Select "individual" as the account type you’re moving over. Robinhood will appear in the list of outside brokerage firms. Click on it.

On the next page, you can link your Robinhood account using its login credentials or enter your account number. You’ll then have the option to choose either a full or partial transfer. Complete the remaining steps and provide any required details. Once Vanguard receives the request, they’ll notify Robinhood. There’s nothing else you need to do.

Fourth, wait. It should take about a week and a half for your assets to move from Robinhood to your Vanguard account.

Robinhood charges $100 to transfer your account out. If you

move your Robinhood account to Webull, Webull will reimburse the $100 transfer fee if your transfer is valued at $2,000 or more.

Free Webull Account

Open Webull Account

Updated on 9/30/2024.

|