Highlights of Trading Futures on thinkorswim

• Charles Schwab allows trading in futures contracts and options on futures.

• Unlike stock trades, futures and options on futures at Schwab come with commissions.

• Schwab's advanced trading platform, thinkorswim, can be used for futures contracts.

Overview of Futures Trading on thinkorswim

Schwab is more than just a broker for stocks. It offers futures trading with educational resources and software to support it. Here’s an overview:

Available Contracts and Accounts

Schwab clients can trade a wide range of futures contracts, including energy, agriculture, metals, stock indexes, and interest rates. Futures on bitcoin and ether are also available. Here are some examples:

| Contract | Symbol | Options | Multiplier | Minimum tick size | Settlement |

|---|

| Corn | /ZC | Yes | $50 | 0.25 = $12.50 | Physical |

| Brent Crude Oil | /BZ | No | $1,000 | 0.01 = $10.00 | Cash |

| Canadian Dollar | /6C | Yes | $100,000 | 0.00005 = $5.00 | Physical |

| U.S. 30-Year Bond | /ZB | Yes | $1,000 | 01 or 1/32 = $31.25 | Physical |

Contracts at Schwab come from different exchanges, like ICE Futures U.S. and the Chicago Mercantile Exchange.

Not all account types are allowed for futures trading at Schwab. For example, futures trading is not available in retirement or custodial accounts.

Opening a thinkorswim Futures Account

Before you can trade futures on Schwab’s thinkorswim platform, you need to open a dedicated futures account. Your regular stock account won’t work for this.

To open a futures account, log into the website and go to the Trade tab at the top. In the drop-down menu, click on Futures. On the next page, there will be a green button to open a futures account. Click it and follow the on-screen instructions to set up the account.

Open Thinkorswim Account

Futures Education

Once your account is open, it's a good idea to prepare for trading. Schwab offers educational resources on futures for both beginners and experienced traders. These can be found under the Learn tab on the website, where you'll see a link to the futures page.

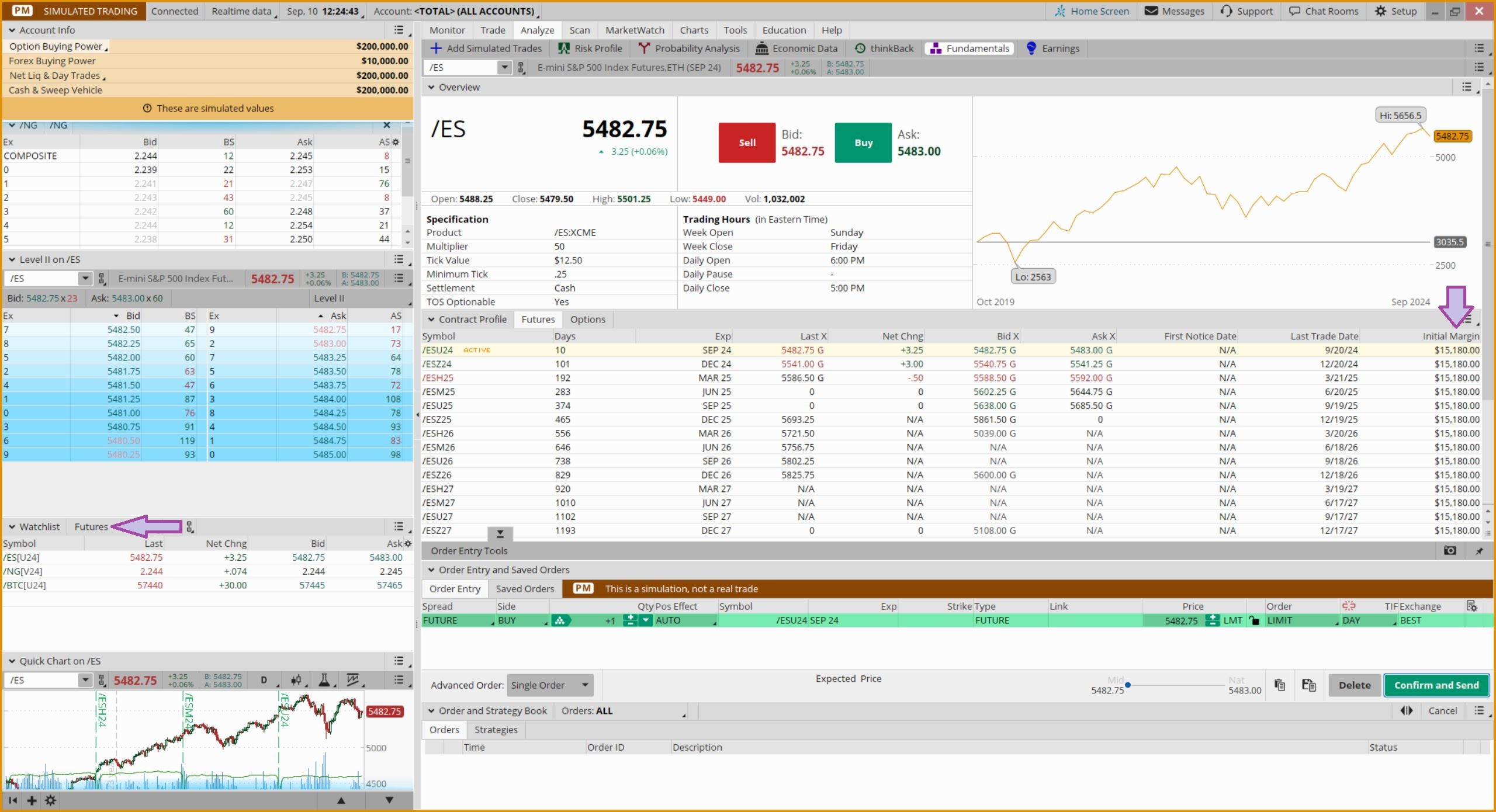

Simulated Trading

After learning, it's time to practice. Schwab’s thinkorswim platform offers a simulated trading feature called paperMoney, which lets you practice futures trading without risk. This is a great way to get familiar with futures trading before using real money.

thinkorswim is the only platform at Schwab that supports futures trading. It comes in three versions: a mobile app, a browser platform, and a desktop program. All three versions offer paperMoney, so choose your preference and make sure you’re in demo mode before placing your first trades.

To set up the futures trading workspace on the desktop platform, click the Trade button at the top and select Futures Trader. This will bring up dealing boxes for futures contracts along with small graphs.

To find the pre-installed watchlist of futures contracts on thinkorswim desktop, click the plus sign (+) in the bottom-left corner and select Watchlists. Look under “Public (F - P)” for the futures contracts list.

Live Trading

When you’re ready for live trading, use the same platform. Just make sure paperMoney is off. In the futures dealing boxes, you can click the down arrow to get a menu that allows you to turn off order confirmations for faster trading. This increases risk but speeds up the process.

Pattern Day Trading

Futures contracts are not subject to pattern day-trading rules, so you can day trade them without worrying about account minimums.

thinkorswim Futures Margin Requirements

Margin in futures trading works differently than in stock trading. Instead of borrowing money, margin is a good-faith deposit required for both long and short positions. The amount of margin needed depends on the contract, typically ranging from 3% to 12% of the contract’s value. This is the amount of cash needed to open a position. There’s also a maintenance margin, which varies by contract.

You can find the initial margin requirement on thinkorswim. Go to the Analyze tab on the desktop platform, then select the Fundamentals sub-tab. Enter the ticker symbol to get a list of details. The Initial Margin is shown in the far-right column.

thinkorswim Futures Fees and Minimums

At Schwab, trading futures and options on futures costs $2.25 per contract, per side. There’s no extra fee for using a live broker, and there’s no minimum account balance beyond the margin requirements for each contract.

Open Thinkorswim Account

Updated on 8/14/2024.

|