Charles Schwab Promotion

Open Schwab Account

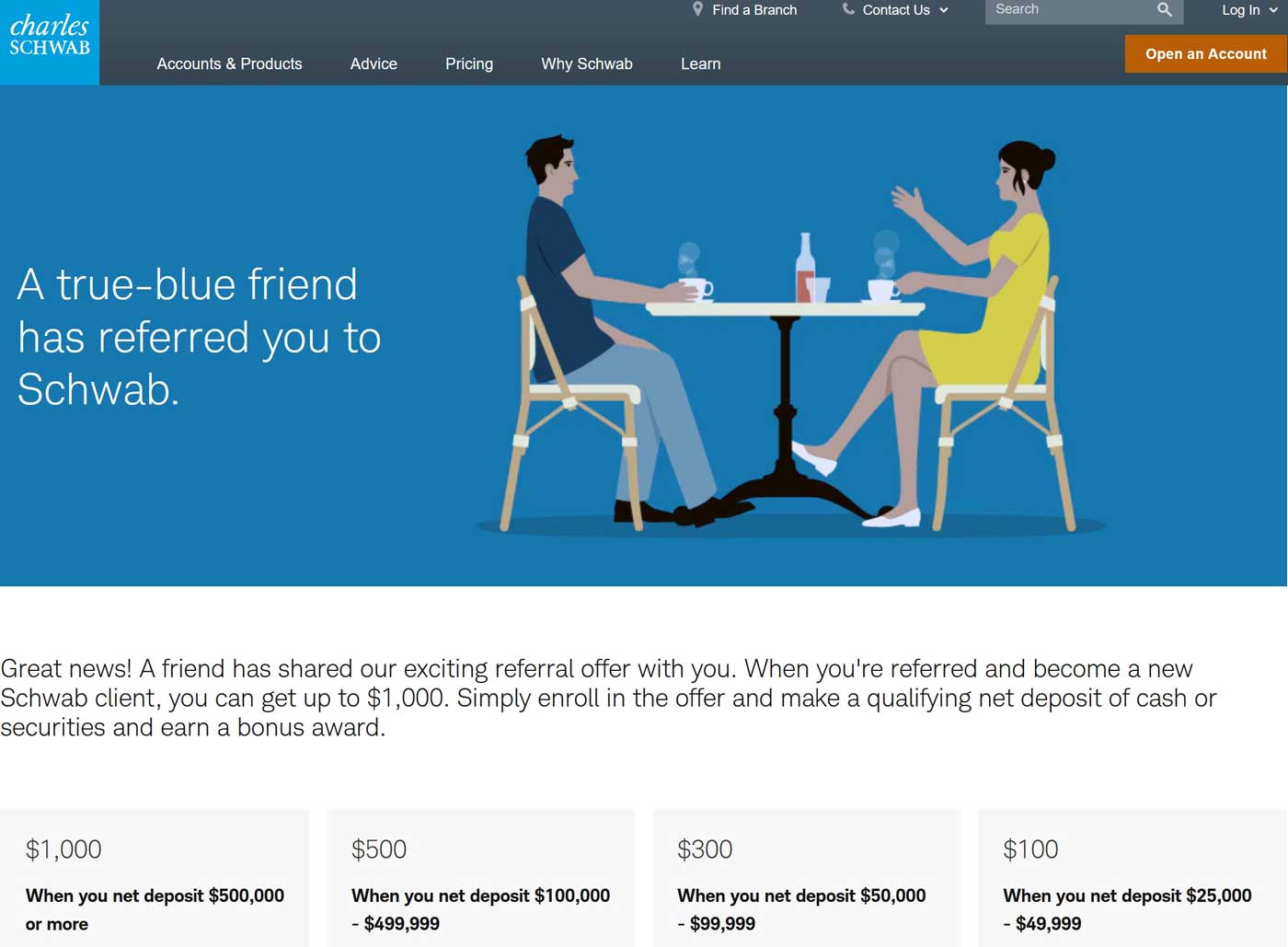

Charles Schwab Referral Bonus

Use this referral link:

https://www.schwab.com/client-referral?refrid=REFER6QWRF

Charles Schwab Bonus Details

| Schwab Bonus | Deposit or Transfer |

|---|

| $1,000 | $500k+ |

| $500 | $100k - $499.9k |

| $300 | $50k - $99.9k |

| $100 | $25k - $49.9k |

Charles Schwab IRA Overview

Investors planning for retirement should take a look at Charles Schwab, a low-cost broker that offers Individual

Retirement Accounts (IRAs) and much more. With helpful retirement specialists, this brokerage house

is worth checking out.

IRA Account Types

Schwab offers different types of IRA’s. Investors can choose from Traditional, Roth, Inherited, Rollover, and Custodial. A Traditional IRA is designed for investors who will be in a lower tax bracket during retirement, whereas the Roth was built for investors who will be in a higher tax bracket after working. As the name implies, an Inherited IRA is a retirement account that has been inherited from a deceased person's estate. The Rollover IRA is a retirement account that has been converted from an employer-sponsored plan. Finally, the Custodial IRA account was made so that parents could help their kids save and invest. These funds can be used for retirement, or in certain cases, for education expenses and to purchase a home. Schwab has retirement specialists who can assist clients with establishing an any type of IRA.

Charles Schwab IRA Minimums Investments

All Schwab retirement accounts have no setup fee, no annual charge, and no inactivity fee. The broker requires a minimum opening deposit of $0 for all IRA types except the Custodial account.

After the retirement account is opened, Schwab’s regular brokerage commission schedule applies. This includes $0 stock and ETF trades. Using a human broker to place a trade tacks on an extra $25. Alternatively, using the broker's automated phone system is just an additional $5.

Charles Schwab Bonus

Open Schwab Account

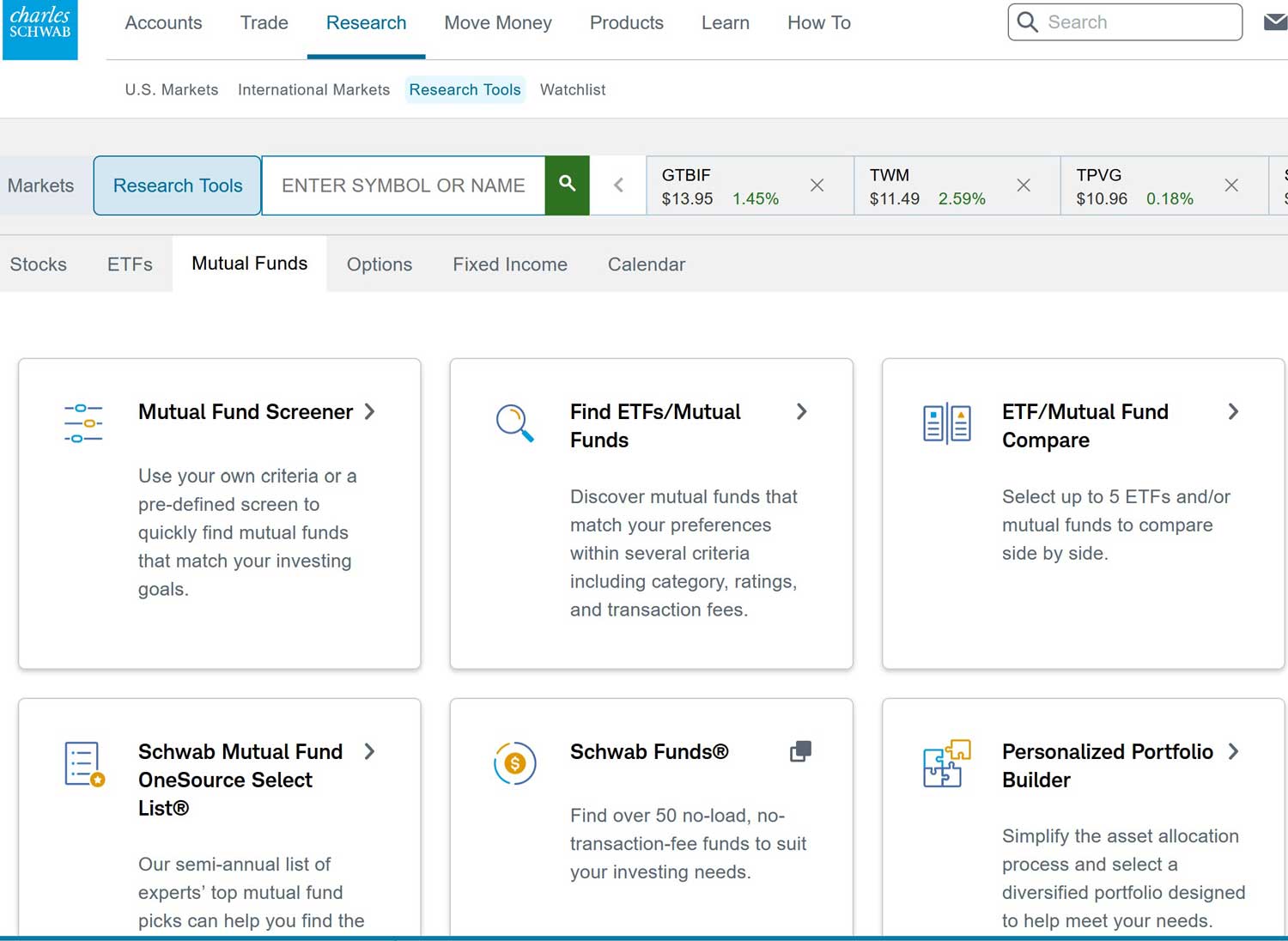

Mutual Funds

Retirement savers who are interested in mutual funds will not be disappointed with Schwab. The broker offers more than 5,000 mutual funds for investors to trade. More than 3,500 of these are OneSource funds, which always have no load and no transaction fee. There is a very steep $49.95 commission to purchase transaction-fee mutual funds, although there is no fee to sell.

At the broker all exchange-traded funds are free to trade. These include defensive equity, investment-grade bonds, REIT's, and a few S&P 500 funds.

Roth IRA Conversion Calculator

The broker also has a handy calculator for investors who are considering converting a Roth IRA to a Traditional. Users simply input required data into the tool, such as tax bracket, date of first withdrawal, and account value. The calculator then determines if making the conversion would be profitable or not.

IRA Videos

The broker has a good library of educational videos on its website relating to retirement accounts. These videos cover a variety of important topics, such as how to rollover a 401(k) into a Roth IRA, using an IRA for estate planning, and account recharacterization.

IRA Investing with Schwab's Intelligent Portfolios

An IRA can be managed by Schwab Intelligent Portfolios. This is a computerized investment advisory service that creates and monitors an account at no charge. There are also no commissions charged for the trades in the account. To qualify for this service, an initial deposit of at least $5,000 is required.

Retirement Income Planning

Also on Schwab's website is a useful tool to help investors analyze their retirement planning, and compare their plans with what Schwab recommends. A retirement income planning quiz covers areas such as what types of income are best for retirement, from what types of accounts withdrawals should be made first during retirement, and how often a retirement account should be rebalanced.

Comparison

Schwab promotion is attractive, and $0 minimum opening deposit requirement is lower than what several other brokers currently require.

Fidelity has $2,500 minimum, for example. Schwab's educational and research

tools for retirement planning are much better than what OptionsHouse and Firstrade offer. Schwab also provides more commission-free funds than many other brokers, such as Merrill Edge.

Funds without trading fees should appeal to retirement savers.

Charles Schwab IRA Promotion

Open Schwab Account

Updated on 11/1/2024.

|