Webull IRA Review

If you're looking to build a retirement fund, an Individual Retirement Account (IRA) is a great way to start. With easy setup and tax benefits, an IRA is very user-friendly. Webull does offer IRAs but has some limitations. Here’s a closer look:

Webull IRA Overview

Webull offers two types of IRAs: Roth and Traditional. However, they do not provide small business IRAs or other types like SEP, SIMPLE, Minor, and Inherited IRAs.

Webull only allows customers to open one IRA, either Roth or Traditional. It’s not possible to have both, which is an unusual policy in the industry.

Webull IRA Fees and Minimums

Webull is known for being a low-cost investment firm, and this extends to its IRAs. There are no fees or minimums for opening or maintaining an IRA. You can even open an IRA with $0. There are no annual fees or fees to close an IRA.

IRAs at Webull benefit from the same low pricing as other accounts, meaning online trades typically have zero commissions.

Available Assets

Webull offers trading in stocks, options, ETFs, and closed-end funds.

Webull does not offer trading in mutual funds, so you cannot invest in a lifecycle fund. Additionally, fixed-income securities are not available, so building a bond ladder in your IRA is not possible.

Opening a Webull IRA

Webull’s user-friendly software makes it easy to open an IRA. It takes just a few minutes on the company’s website. Be sure to select whether you want a Roth or Traditional IRA.

If you already have a taxable account with Webull, you can log in, click on your account name in the top-right corner, and select "My Account." From there, you can easily open an IRA with pre-filled personal information.

Open Webull IRA

Get up to 40 free stocks when you deposit money at Webull!

Open Webull Account

Webull Rollover Service

Webull accepts rollovers of retirement plans from previous employers. The first step is to open an IRA with Webull if you haven’t already. Then, contact your old employer’s HR department to request a rollover into your Webull IRA. You’ll need to fill out some paperwork, but once that's done, your old account will appear in your Webull IRA as cash.

The entire process could take up to two weeks if everything goes smoothly. If there are any issues, it could take longer.

Webull accepts rollovers from 403(b), 401(k), and 457(b) plans, as well as SEP and SIMPLE IRAs. There are three methods to complete a rollover: wire, check, and 60-day rollover.

With the wire option, the plan administrator will sell all holdings and wire the cash balance to Webull. Provide the following details to the plan administrator:

| Field | Details |

|---|

| Amount | U.S. Dollar amount |

| Recipient Bank Name | BMO Harris Bank

111 W Monroe St, Chicago, IL 60603 |

| ABA Number | 071000288 |

| SWIFT Code | HATRUS44 |

| For the Benefit of (FBO) | Apex Clearing Corporation |

| Bank Account Number | 1617737 |

| Beneficiary's Address | One Dallas Center, 350 N. St Paul Suite 1300 Dallas, TX 75201 |

| Beneficiary's Phone Number | 888-828-0618 |

| Name on the Webull account and the 8-digit alphanumeric account number 5XXXXXXX |

Alternatively, the employer could send the balance via check, made payable to “Apex Clearing Corporation FBO (account holder’s name and account number),” and send it to:

Apex Clearing Corporation

c/o Banking

350 N St Paul Street, Ste 1300

Dallas, TX 75201

The third method is the 60-day rollover, where the check is sent to you, and you have 60 days to send it to Webull. Taxes might be withheld in this method, so consult a tax advisor before proceeding.

Webull charges nothing to receive a transfer, but the outgoing firm may charge a fee. Roth accounts cannot be rolled into a Traditional IRA.

Webull IRA Transfer

Transferring an IRA from another brokerage firm to Webull is simpler and doesn’t involve selling assets, as long as Webull supports those assets. This process typically starts with Webull, the incoming firm.

Webull has an online form for account transfers. To find it, open the mobile app, tap on the Menu icon, and scroll through the Promotion Center tiles until you see the account transfer bonus. Tap on it for details on Webull’s transfer specials, if available at the time.

On the transfer page, tap on the button to transfer an IRA and follow the instructions. You can also transfer an IRA via Webull’s website by going to the My Account page and clicking on "Transfer Stocks."

In the drop-down menu for the receiving account, select the IRA (if you have more than one account at Webull) for the form to work. The minimum transfer amount is $500. Webull doesn’t accept option contracts expiring in less than 2 weeks, naked options, pink-sheet stocks, or over-the-counter instruments.

Open Webull IRA

Get up to 40 free stocks when you deposit money at Webull!

Open Webull Account

Software

A Webull IRA has access to the same trading software as other accounts, including a mobile app, desktop program, and browser platform. These tools include multiple order tickets, full-screen charting, a stock screener (but no ETF screener), and multiple trading layouts on the desktop system.

Managing an IRA

Webull does not allow shorting, option spreads, or margin trading within an IRA. The account balance can never be negative, and day trading is only possible with settled funds. An IRA at Webull is essentially a cash account.

Webull supports recharacterizations and the Backdoor Roth strategy. Withdrawals from an IRA must be done using a paper form.

Adding a Beneficiary to an IRA

While a taxable account at Webull cannot add a beneficiary, an IRA can. Adding a beneficiary is easy to do on either the mobile app or website.

On the app, tap on the bull’s horns icon, then tap the settings icon in the top-right corner. Next, tap "Modify Account Profile" and scroll down to add a beneficiary.

On the website, go to the My Account page and click on "Manage My Account." From there, you can add a beneficiary.

Webull Retirement Advice

Webull does not offer investment advice or financial planning services. There are no robo accounts or advisory services, and all accounts are self-directed. As mentioned earlier, there are no lifecycle mutual funds available.

Retirement Education

Webull’s website has a learning hub and a FAQ center with helpful information for new customers, though most resources are not focused on IRAs or retirement planning. The FAQ page does have a brief section on IRAs, covering topics like:

- How can I recharacterize my Roth IRA into a Traditional IRA?

- What are the requirements to open a Traditional IRA?

- Does Webull support a Backdoor Roth?

Webull IRA Review Judgement

Webull outperforms one of its major competitors, Robinhood, which doesn’t offer IRAs at all. Webull’s trading software is better than Robinhood’s, with features like full-screen charting and right-click trading.

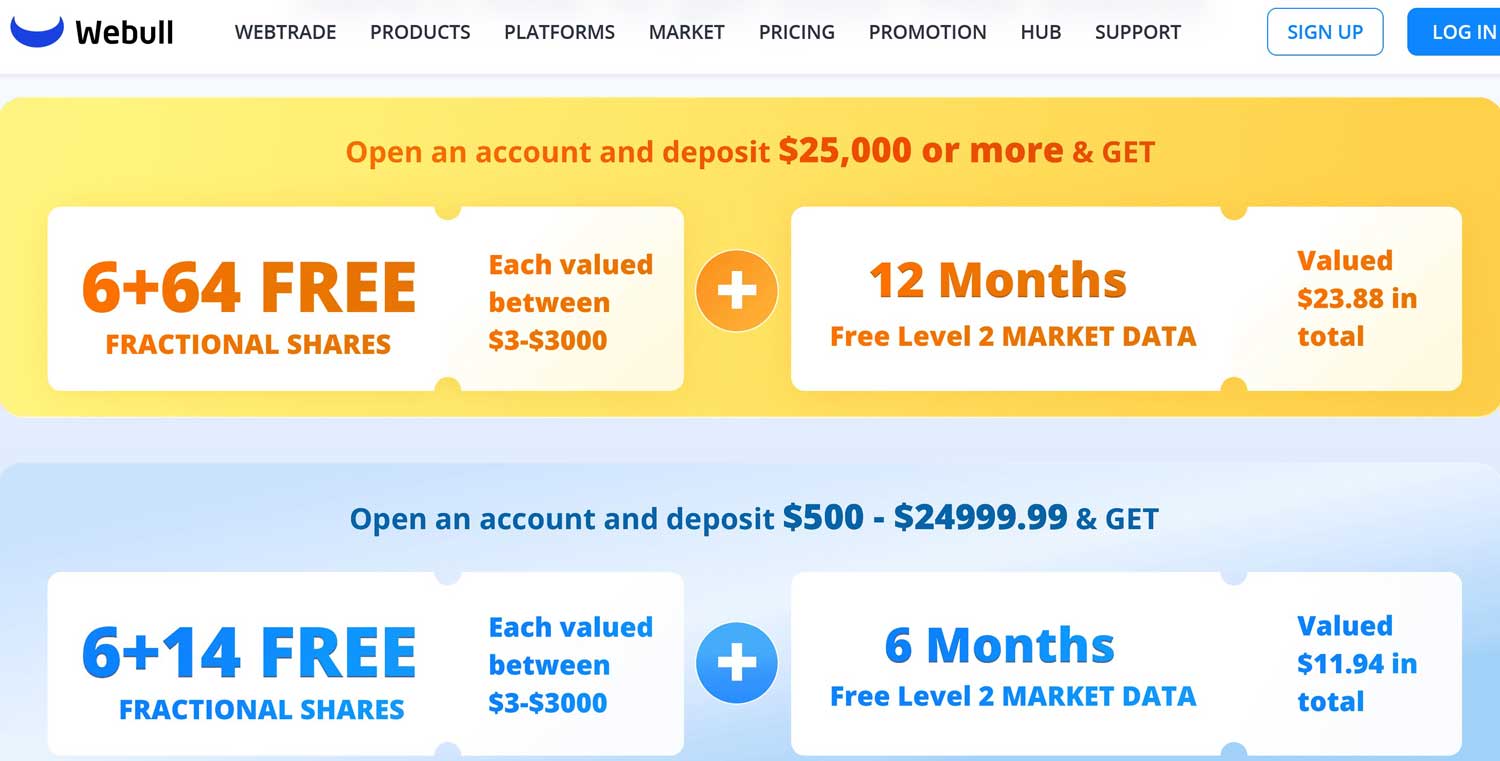

Webull IRA Promotion

Get up to 40 free stocks when you deposit money at Webull!

Open Webull Account

Updated on 7/19/2024.

|