Fidelity IRA Review

Fidelity Investments is a top choice for retirement savings. It offers a wide range of IRA services along with many self-directed and advisory tools that can be highly beneficial for retirement accounts.

Fidelity IRA Overview

Fidelity provides six different IRA options: SEP, SIMPLE, Roth, Traditional, Minor, and Inherited. The Inherited IRA can be structured with Roth tax benefits if preferred. The Minor IRA is available only in Roth format.

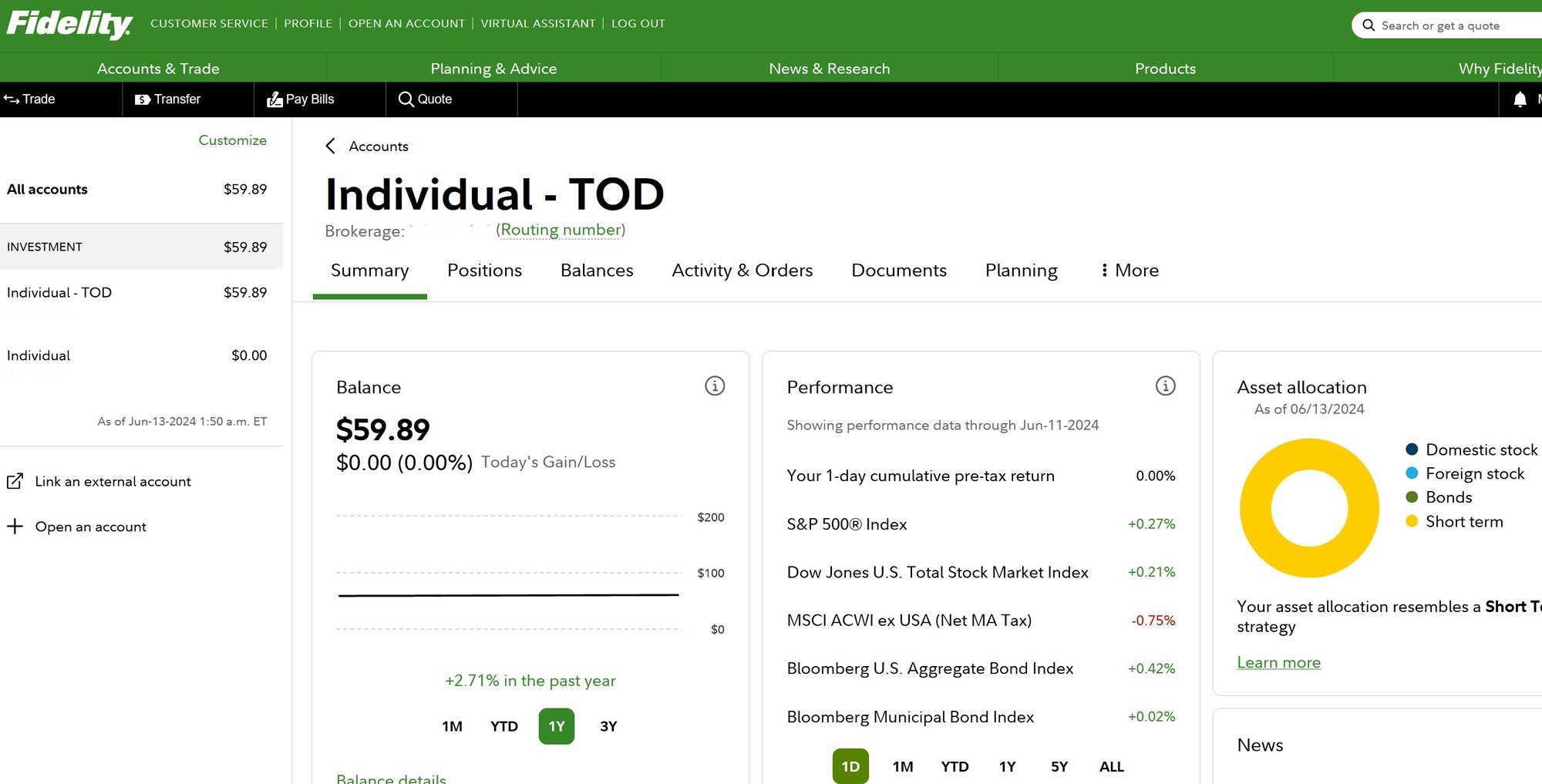

You can open multiple IRAs at Fidelity under one tax ID number, and all accounts, including taxable ones, can be managed with a single login.

Fidelity IRA Minimums and Fees

Fidelity does not charge any fees or require minimum balances for its IRAs. There’s no minimum balance needed to open an IRA, and no deposit is required. The account is free from ongoing fees like annual, maintenance, and closeout fees.

Fidelity has also eliminated commissions for online trades of U.S.-listed stocks and ETFs, which applies to IRAs as well.

Tradable Assets

The same range of investments available to taxable accounts is also available for IRAs in self-directed mode at Fidelity. These include:

- Option contracts

- Funds (mutual, exchange-traded, and closed-end)

- Stocks (including OTC and some foreign exchanges)

- Bonds and other fixed-income instruments

Using Fidelity’s mutual fund screener, available on its website, we found 460 target-date mutual funds designed for retirement saving. These funds adjust their investment strategy as the target retirement date approaches.

IRA Modes at Fidelity

At Fidelity, an IRA can be either self-directed or managed. Managed accounts come in various formats, including a robo-advisor service and several traditional options.

While there are no fees for the IRAs themselves, there is a charge for portfolio management. The automated program, Fidelity Go®, costs 0.35% annually once the account balance reaches $25,000. Below that amount, the service is free.

The list of tradable assets mentioned earlier applies to self-directed accounts. Managed accounts have a more limited selection, with the robo service trading only a small set of Fidelity mutual funds with no expense ratios.

Opening an IRA at Fidelity

Opening an IRA with Fidelity, whether self-directed or robo-managed, is straightforward using the website or mobile app. On the website, look for the link to open a new account at the top of the page. Links for Roth and Traditional IRAs are displayed prominently, and other IRA types are available under a separate link.

On the mobile app, tap the More icon (three dots) in the bottom menu, then scroll down to find the link to open an account. Follow the instructions to complete the process.

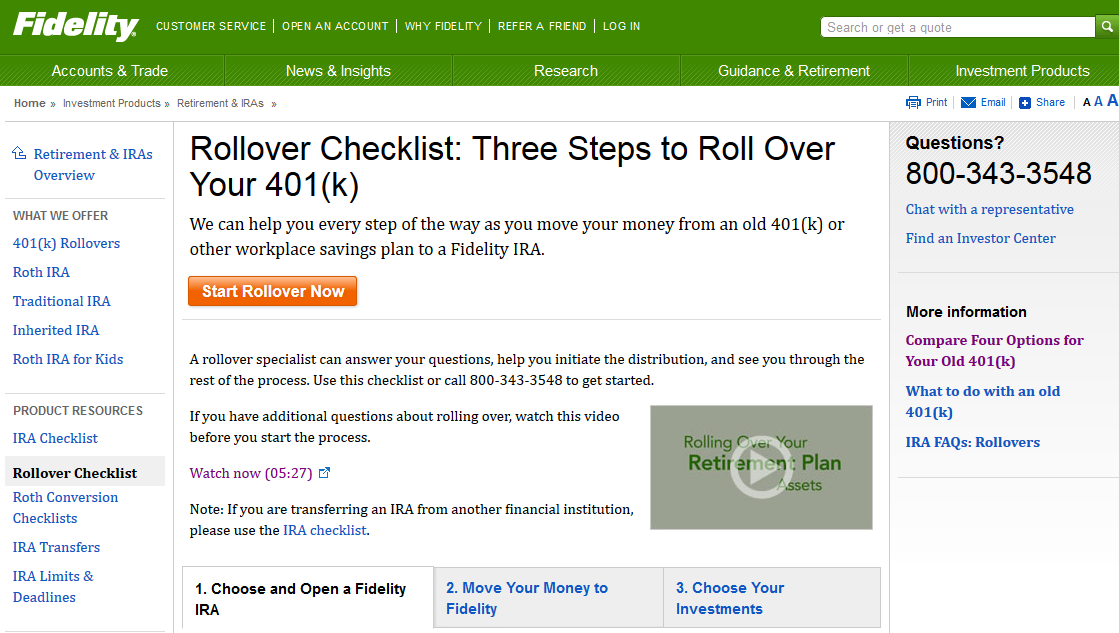

Fidelity Rollover Service

Fidelity offers a Rollover IRA option, accessible via both the website and mobile app. This account allows you to transfer an old employer’s retirement plan, such as a 401(k), into a Fidelity IRA.

To initiate the rollover, simply click on the Rollover IRA link and follow the on-screen instructions. If you already have an IRA at Fidelity, it can still be used for the rollover. Contact your previous employer’s HR department to request a rollover of your plan’s assets into your Fidelity IRA.

If your previous employer liquidates the account and sends cash, the check should be made payable to “Fidelity Management Trust Company, FBO [your name],” with the Fidelity IRA account number on the memo line. You can also wire funds to Fidelity using the provided account information.

IRA Transfer

Moving an IRA from another brokerage to Fidelity is easier and involves less paperwork. This process is called a trustee-to-trustee transfer, and it can be done online through Fidelity’s website or mobile app.

On the website, hover over the Accounts & Trade tab and select Transfers. Choose “Transfer an account to Fidelity” and complete the form. On the mobile app, go to the Transact page, select the Transfer link, and follow the instructions.

Transferring a Roth IRA to a Roth IRA or a Traditional IRA to a Traditional IRA has no tax consequences. However, converting from Traditional to Roth could have tax implications, so consult a tax professional before proceeding.

If the outgoing brokerage charges a transfer fee, Fidelity will reimburse it for transfers valued at $25,000 or more.

Contributions and Withdrawals

Once your Fidelity IRA is set up, contributing and withdrawing funds is simple. You can fund your IRA through ACH, PayPal, wire transfer, or an internal transfer from another Fidelity account. On the mobile app, you can deposit a check digitally.

You can also set up a recurring monthly deposit. Fidelity’s software keeps track of your total contributions for the year.

Withdrawals can be made online, with a maximum of $100,000 per day. You can also lock down your IRA to prevent unauthorized withdrawals by using the Security Center on the website.

Limited Margin

While IRAs can’t have full margin accounts due to federal regulations, Fidelity offers limited margin, which allows trading with unsettled funds. This feature can be added to your IRA through the Account Features section on Fidelity’s website.

Retirement Advice

IRA customers who enroll in Fidelity’s robo service receive free phone consultations with financial advisors, provided their account balance is at least $25,000. Traditional wealth management options are also available, though they come with higher fees and minimums.

Retirement Education

Fidelity offers a wealth of IRA resources for self-directed investors. These resources can be found on the website, particularly under the Planning & Advice tab and the News & Research tab. Examples include articles on getting started with IRAs, choosing between Traditional and Roth accounts, and IRA tax tips.

Best IRA Accounts

Other Financial Services

Fidelity offers annuities, long-term care insurance, and life insurance that can be purchased within an IRA.

Fidelity IRA Review Assessment

With a wide range of IRA tools and resources, Fidelity is one of the best places to open an IRA.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Updated on 7/19/2024.

|