Overview of Interactive Brokers and Cash App

Are you considering opening an investment account? Cash App and Interactive Brokers both offer trading accounts, but they are quite different in many ways.

Costs

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

IB

|

|

|

|

|

|

|

|

Cash App

|

|

|

|

|

|

|

Promotions

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Cash App:

Use U2Q3HN referral link to get $10 cash bonus.

Accounts and Tradable Assets

Interactive Brokers offers a wide range of account types, including taxable and tax-deferred options like joint accounts and trusts.

There are two ways to invest: robo-advisory and self-directed. The self-directed accounts provide access to a broad range of assets, including stocks, cryptocurrencies, bonds, mutual funds, options, forex, and more.

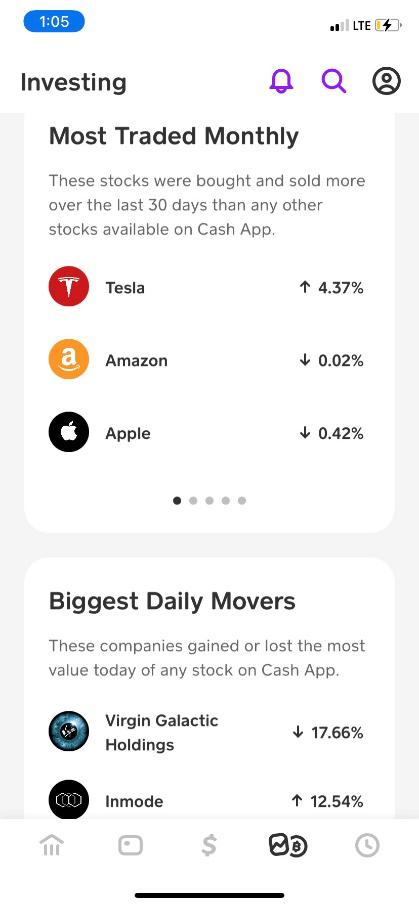

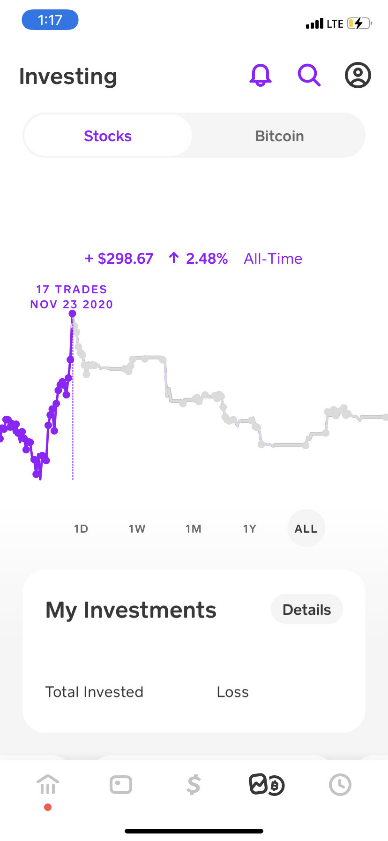

Cash App, on the other hand, offers a much simpler experience. It provides trading in a limited selection of stocks and ETFs, with bitcoin as the only cryptocurrency available.

Cash App only offers individual taxable accounts and does not have robo-advisory services.

Winner: Interactive Brokers

Computer Software

Interactive Brokers provides multiple trading platforms. Its website features a robust order ticket with advanced trade options, and the charts are sophisticated with full-screen mode and many tools.

There’s also Trader Workstation, a desktop platform that offers an elevated trading experience. It includes direct-access routing and advanced options tools like a probability lab.

Cash App has no desktop platform, and its website is quite basic, without any trading or research tools.

Winner: Interactive Brokers

Mobile Platforms

Moving from Trader Workstation to the IBKR mobile app is a bit of a step down, but the mobile platform still offers powerful tools. For instance, there’s a wheel-order entry ticket that lets you quickly submit a trade using pre-populated numbers. The order ticket works only in horizontal mode. An AI assistant is also available, though it can only answer some questions.

Cash App doesn’t have AI, but it does allow trading on its app. The downside, or perhaps upside depending on your needs, is that the app is very simple. It only offers three order types, so advanced trading isn’t possible. Charts are basic, with no tools or horizontal mode. In contrast, the IBKR app has more advanced features.

Winner: Interactive Brokers

Margin Service

Interactive Brokers offers both cash and margin accounts, with attractive interest rates for margin trading. IBKR Lite customers pay a flat 7.33% for U.S. dollar accounts, while IBKR Pro clients get lower rates, and rates for other currencies may vary.

Interactive Brokers also provides detailed margin information on entered ticker symbols, available on both Trader Workstation and the website. This includes:

- Reg-T Initial Margin

- Portfolio Maintenance Margin

- Reg-T Maintenance Margin

Although Cash App offers margin accounts, they cannot be used for margin trading.

Winner: Interactive Brokers

Additional Services

Automatic Mutual Fund Purchases: Not available at either firm.

Extended-hours Trading: Interactive Brokers offers both pre-market and after-hours trading.

Fractional Shares: Both firms allow the purchase of fractional shares, though at Cash App, it’s the only option.

DRIP Service: Interactive Brokers offers automatic dividend reinvestment for stocks, but Cash App does not.

Initial Public Offerings: Not available at either brokerage.

Banking Tools: Both firms offer debit cards, but Cash App provides more banking features, including customizable cards.

Stock Yield Enhancement Program: Available at Interactive Brokers, but not at Cash App.

Tax Service: Only available at Cash App.

Individual Retirement Accounts: Only available at Interactive Brokers, which offers Roth, Traditional, and SEP IRAs.

Winner: Interactive Brokers

Recommendations

Active Stock Trading and Day Trading: Interactive Brokers is the clear choice, offering a wide range of tools for day trading, including maker-taker fees, technical indicators, Level II quotes, margin accounts, a short-locate widget, and bracket orders.

Mutual Fund Trading: Interactive Brokers is the only option.

Beginning Investors: Consider a robo account with Interactive Advisors, an affiliate of IBKR.

Small Accounts: There are no minimums for self-directed accounts. Both IBKR Lite and Cash App offer commission-free trading on U.S.-listed stocks and ETFs. Interactive Advisors requires $100 to start.

Retirement Savers and Long-term Investors: An IRA with Interactive Brokers or Advisors is a solid choice. The company offers target-date mutual funds in self-directed accounts.

Interactive Brokers vs Cash App Summary

While Cash App has some appealing banking features, it can't compete with Interactive Brokers for trading.

|