Is M1 Finance Safe?

Yes, M1 Finance is a perfectly safe option for your investment needs. There's nothing about the broker to suggest any scams. While M1 Finance is trustworthy, it offers a unique approach to investing that might not suit everyone.

Continue reading if you want to learn more about what makes M1 Finance a safe place to invest.

Is M1 Finance Legitimate?

M1 Finance follows all necessary industry regulations. The broker is registered with both the SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority).

M1 Finance Promotion

Open M1 Finance Account

Is M1 Finance Insured?

M1 Finance offers robust insurance programs, providing SIPC and FDIC coverage to protect its customers' assets.

M1 Finance BBB Reviews

While the Better Business Bureau (BBB) does not accredit M1 Finance, the broker holds an A- rating. This rating is based on how the company handles customer complaints and its longevity in the business, suggesting M1 operates responsibly.

Our M1 Finance Review

M1 Finance is different from typical brokerages. If you're curious about its services, understanding how the broker works can be beneficial.

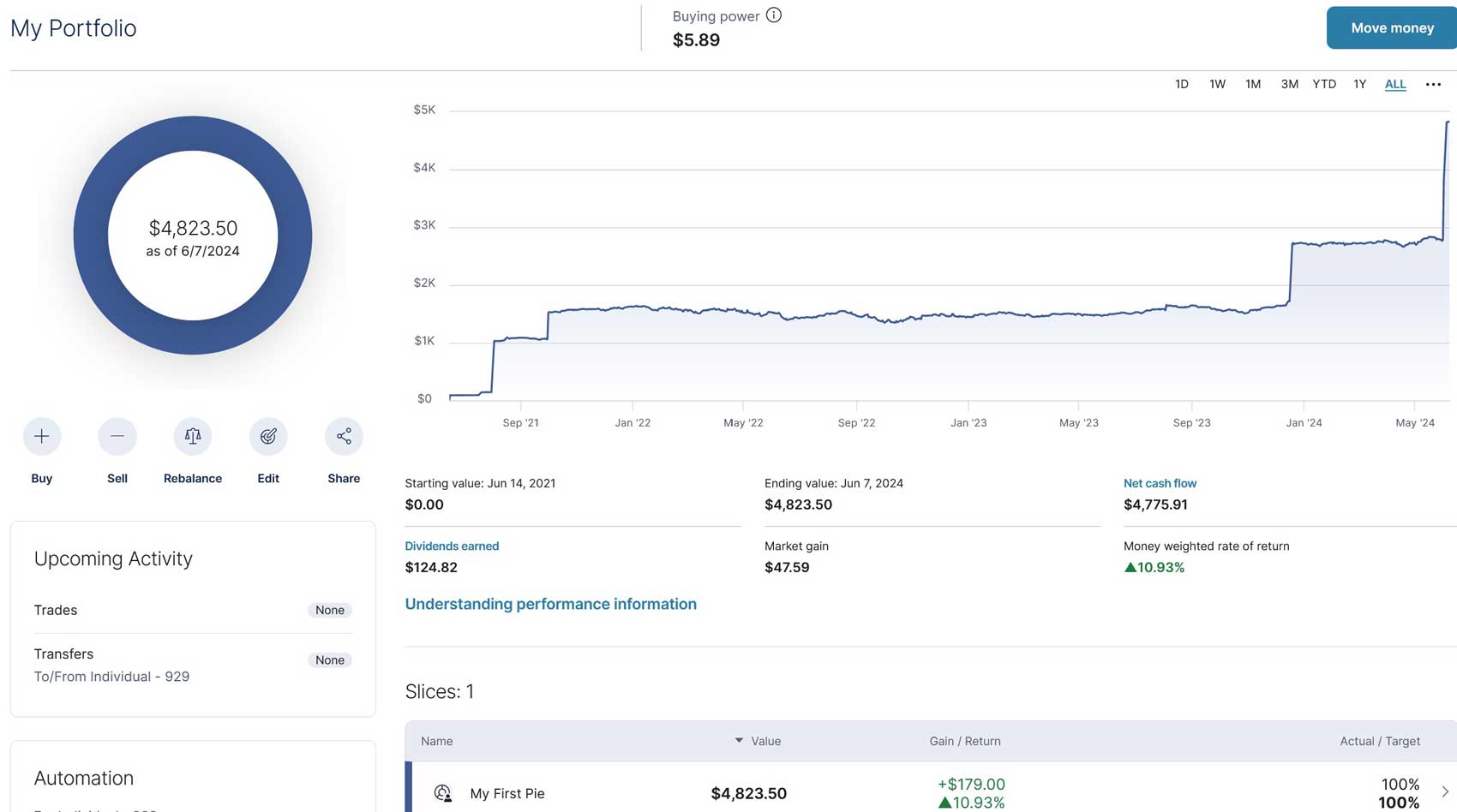

Investment Experience

M1 Finance encourages a long-term investment approach, offering a service that supports this well. Using a 'Pie' concept, investors can customize their portfolios with stocks, ETFs, sectors, and even other pies, creating a diversified balance.

You can build your own investment pie or opt for 'Expert Pies,' which are professionally designed for specific industries and strategies. Rebalancing your pies is straightforward, and you can even transfer slices between pies.

Cryptocurrency investments are handled similarly but require a separate account application.

M1 Finance Promotion

Open M1 Finance Account

Account Types

M1 Finance offers various accounts to suit different needs, including individual and joint brokerage accounts, a range of IRAs, trust and custodial accounts, and high-yield cash management accounts.

Notable Features

M1 Margin Loans: Available if your account balance is at least $2,000, allowing for investment, personal spending, or debt consolidation.

Auto-investing: This feature automatically allocates new deposits based on your pre-set preferences.

M1 Checking Account: Offers an impressive interest rate and is FDIC-insured.

The Owner’s Rewards Card by M1: Provides up to 10% cashback.

M1 Savings Account: Offers a competitive interest rate for Plus members, with FDIC insurance.

M1 Finance Fee

A monthly fee of $3 applies unless your account balance reaches $10,000 at least once each month.

Costs and Fees

While M1 does not charge trade commissions, there are other fees:

- Crypto trades have a 1% spread on buys and sells.

- Wire transfers cost $25.

- ACATS (outgoing) is $100.

- Inactivity fee is $20 for accounts under $20 inactive for 90+ days.

- Regulatory fees are minimal.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

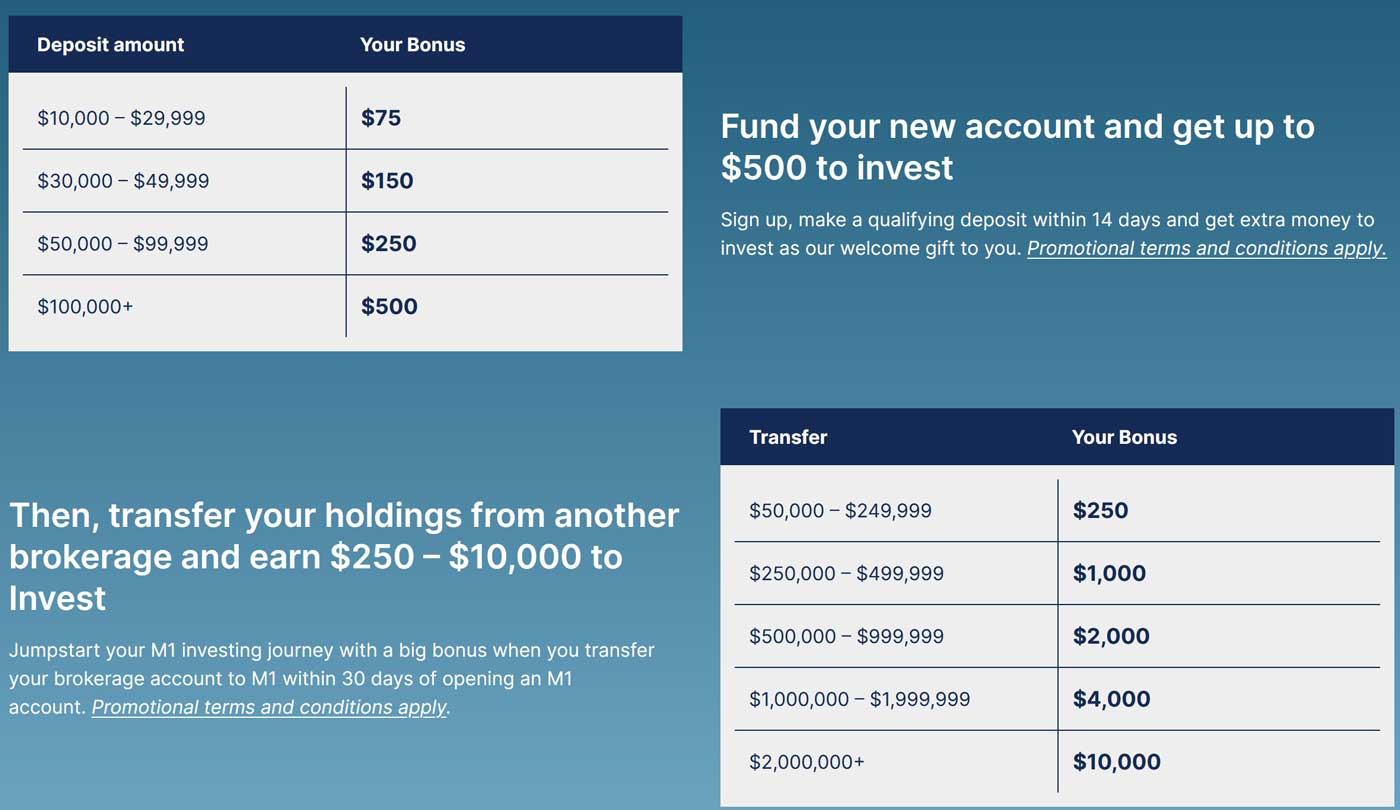

Promotions and Bonus Offers

M1 frequently updates its promotions, generally involving deposit requirements and referral bonuses.

The referral program rewards both the referrer and the new customer with $10 after account funding. ACAT transfer bonuses range from $100 to $4000, depending on the account size transferred.

M1 Finance Pros

M1’s tools support diversified, long-term investment strategies:

- Wide variety of account types

- Extensive selection of securities

- Thematic investing simplifies decision-making for beginners

- Automated investing and portfolio rebalancing

- Visual 'Pie' system for asset allocation

- Generous cashback on cards

- No trade commissions

- Minimal fees

M1 Finance Cons

- No dedicated trading platform

- Limited trading times

- No access to leveraged investments

- Premium features require a subscription

Recommendations

M1 Finance is ideal for those wanting a platform that supports long-term, diversified investing. The Pie system helps investors visualize their portfolio's structure. M1 is great for those who want straightforward, set-and-forget investing.

Active traders seeking advanced tools and more frequent trading opportunities might find M1’s offerings limited due to the absence of a dedicated trading platform and restricted trading hours.

Webull Promotion

Open Webull Account

Updated on 7/5/2024.

|