Is Acorns Offered in Europe

Acorns is not available in European countries (Germany, UK, France, Poland, Spain, Austria, Italy, Sweden, and others).

Open Acorns Account

Open Acorns Account

Alternative to Acorns in Europe

For European investors, we recommend opening an account with these American brokers:

ZacksTrade Website

Open ZacksTrade Account

Axos Invest vs. Acorns Introduction

Both Axos Invest and Acorns are robo-advising services, created to simplify the process of investing and saving money. They are a great introduction to the financial world, minus the steep fees for the in-person human advisors and hours of research required to make informed decisions about the fund allocations. Their target audience and people who would benefit the most from using any or both of the services are hands-off investors. These users are not inclined to spend time and effort reading about market trends and examining stock recommendations. They simply want to have an emergency fund readily available, boost their saving and net worth by delegating investment decisions to someone else.

In terms of investment philosophy, both companies are proponents of modern portfolio theory (MPT). Harry Markowitz, the economist who introduced this term, even helped Acorns to develop their service and approach to building clients’ portfolios. The idea behind modern portfolio theory seems surprisingly straightforward: a diversified portfolio and investment in different classes of assets can lead to better long-term returns and lower risks in general.

Similarities

There is no human advisor option for both of these services, the assets are managed by computer algorithms.

Both Axos Invest and Acorns have automatic rebalancing of their clients’ portfolios. The portfolio gets revised in response to fluctuations of the market and other factors that might influence its growth and allocation of the funds.

Axos Invest and Acorns can help with making investing run on autopilot by utilizing automatic deposits. Customers of these companies can set a regular schedule for investments directly out of their paychecks.

The types of accounts available through both services include personal investment and three types of IRA (Roth, traditional, SEP)

Differences

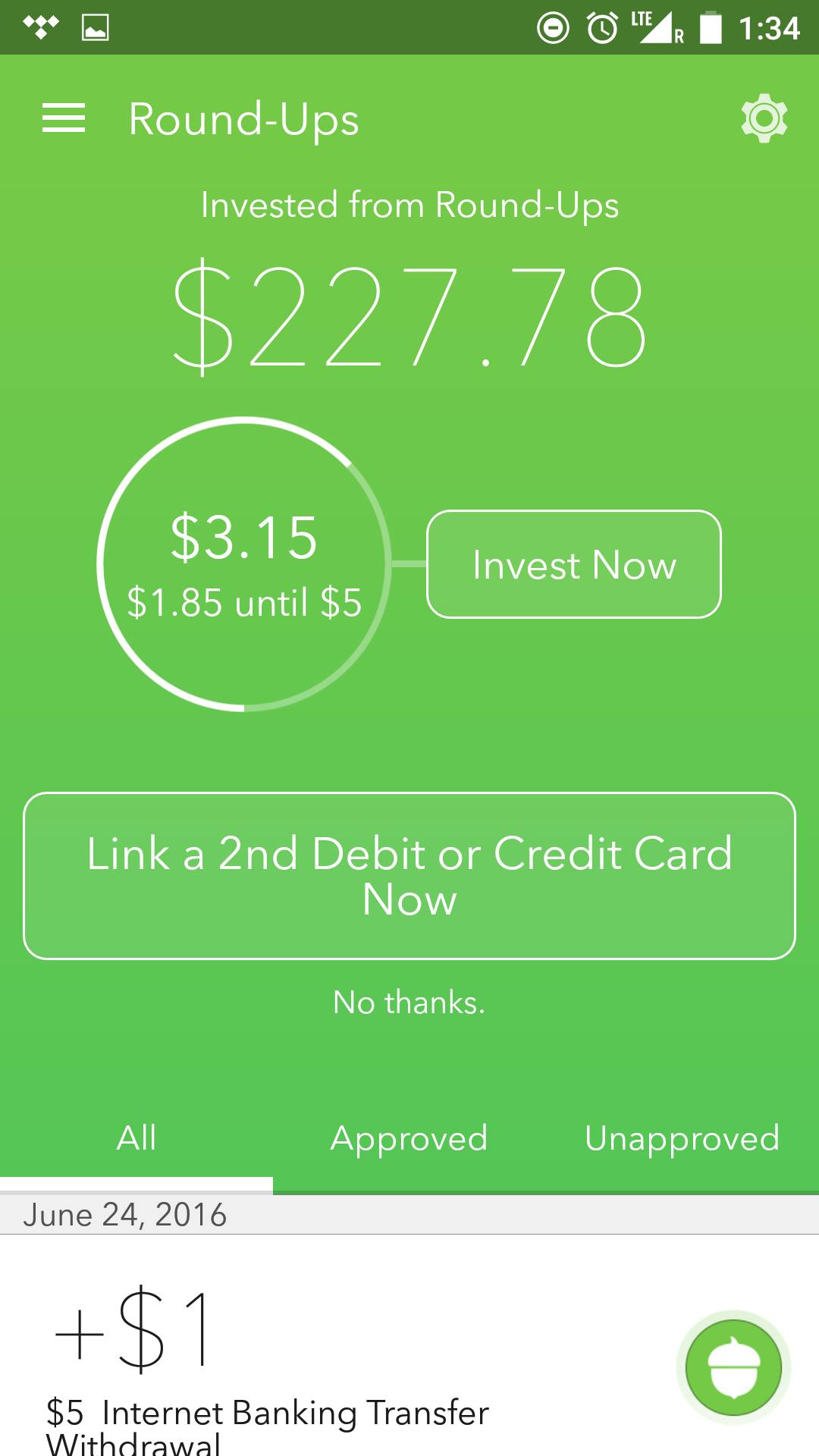

Acorns is a robo-advisor integrated with an automated tool for savings. Their most prominent

difference is a round-up option. If a client has a credit or debit card linked to their Acorns

account and they pay $9.08 at the gas station, $0.92 to round this transaction up would go to their savings account and get invested. The days of saving spare change in piggy banks or clothes pockets are gone, and now it can be utilized to benefit investors in the future.

Axos Invest is just a robo-advisor that manages funds, plain and simple. The current account minimum to become an investor with Axos Invest is $500, Acorns charges nothing for opening an account and you can start investing with a $5 minimum.

Axos Invest charges a flat annual advisory fee of 0.24% on all transactions while Acorns offers three-tier membership: lite ($1/month, only includes a personal investment account), personal ($3/month, additionally includes checking and a retirement accounts), and family ($5/month, all three account types and Acorns Early, a custodial UTMA/UGMA account for children)

Axos Invest offers tax-loss harvesting, Acorns doesn’t have this feature. It is essentially an investment strategy to lower capital gains taxes by selling investments that lost money to balance the earning from winning stocks.

While both companies have mobile apps, Acorns offers a more intuitive and straightforward interface for both their app and website. Axos Invest overwhelms users with a confusing layout. Adding insult to injury, the IT support for this service in general leaves a lot to be desired since sometimes their website shows an error and refuses to work for no apparent reason.

Acorns want to promote a healthy attitude towards savings among younger generations and encourage people to start thinking about their financial goals as early as possible. The company offers up to four years of no fees for students who create their account, using a valid “.edu” email address.

Acorns have a wealth of educational resources available on their website and app for those interested in learning more about the financial and investment world. The content is engaging, easy to understand, and useful for making better and smarter decisions about money in general. Moreover, Acorns and CNBC have a blog called "Grow", where the contributors cover various related topics: investing, saving, borrowing, spending, earning. The readers can also find financial tools and calculators to check compound interest over time, for example.

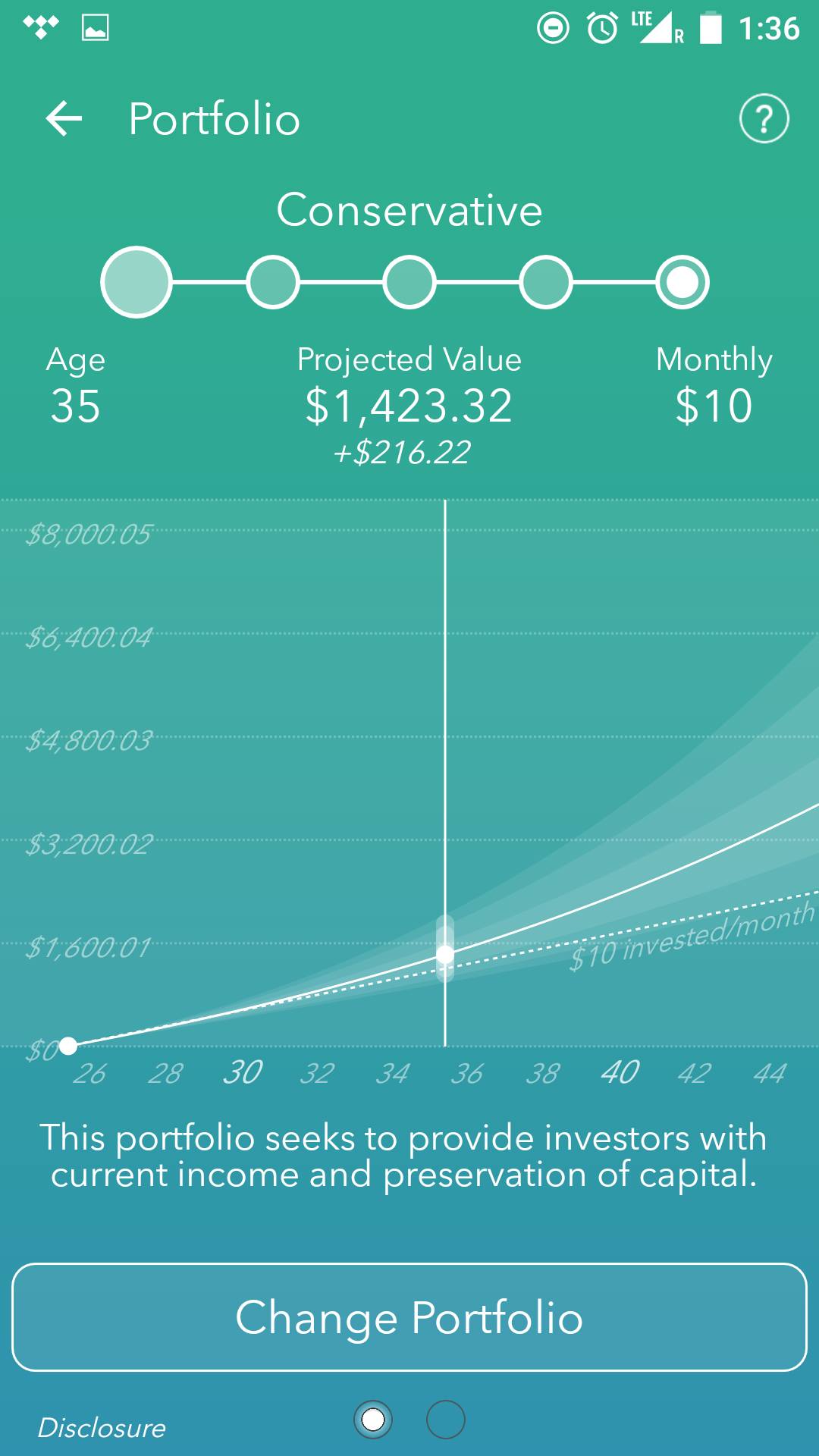

While Axos Invest offers 32 classes of assets, Acorns build portfolios of their clients with ETFs from six: government bonds, domestic large-company stocks, small company stocks, corporate bonds, international large company stocks, small and medium company stocks. Similar to Axos Invest, Acorns creates an asset allocation profile according to the client's financial goals and risk aversion.

If a client wants to transfer their funds to a different broker, a taxable Acorns account is subject to a $50 per ETF fee. In case the investments are sold, and the account is closed, there is no charge.

Acorns Spend is the checking account with a debit card that is supposed to be saving, investing, and earning for its owner. Acorns promise no overdraft fees, no minimum balance, real-time round-ups, and access to 55,000+ fee-free ATMs around the world.

Another distinguishing feature of Acorns is "Found Money". It is a reward program to earn additional cash bonuses, adding more money to users' portfolios. To participate, Acorns clients have to shop with Acorns partners (currently, the list of partners exceeds 300 brands and includes companies like Apple, Walmart, Nike, Expedia, Sephora, etc.)

This might be the most significant difference. Comparing the performance of the aggressive portfolio with Acorns, with the account opened in 2016, the growth consisted of 7.87%. The aggressive portfolio with Axos Invest, with the account opened in 2017, brought 14.35% of growth.

Promotion Links

Acorns:

Get Acorns absolutely free and a $20 bonus.

Axos Invest: none right now.

Acorns app in Europe Disclaimer

Availability of Acorns investing app in Europe (Germany, Great Britain, France, Holland, Poland,

Spain, Austria, Italy, Sweden, and other EU nations) might change without notice at any time.

Updated on 8/21/2024.

|