Custodial Accounts with Merrill Edge

If you’re thinking of opening a custodial account to invest on behalf of a minor, Merrill Edge might have what you need. The brokerage firm offers UGMA and UTMA accounts. Here’s what you need to know:

Merrill Edge UGMA/UTMA Facts

At Merrill Edge, you can choose between the Uniform Gifts to Minors Act (UGMA) account or the Uniform Transfers to Minors Act (UTMA) account. Only Vermont and South Carolina don’t have the UTMA. All 50 states have the UGMA.

The main difference between these accounts is that the UTMA can hold real estate and other physical property, while the UGMA cannot. Merrill Edge doesn’t offer physical assets, so this difference isn’t relevant here. Both accounts are custodial accounts.

Benefits of a Custodial Account

With either a UGMA or a UTMA account, you can enjoy some tax benefits. Under federal law, the first $1,300 in earnings each year in a UGMA/UTMA is tax-free. The next $1,300 is taxed at the child’s tax rate, which is typically lower than the parents’ rate.

A few things to keep in mind:

- The age when this tax benefit ends is 19, or 24 if the minor is a full-time student with little to no unearned income.

- Contributions are permanent, so you cannot change your mind.

- Unlike other minor accounts, funds in a UGMA/UTMA can be used for any purpose, not just education.

Custodial Account Fees at Merrill Edge

Along with the tax benefits, Merrill Edge doesn’t charge any fees for a UGMA or UTMA account. There are no annual fees, setup fees, or closeout charges. Even better, a custodial account at Merrill Edge follows the same commission schedule as a regular taxable brokerage account. This means no trade fees on stocks and ETFs. Options have no base charge, and the per-contract fee is 65¢. Treasury bonds also have no commissions, which is another great perk.

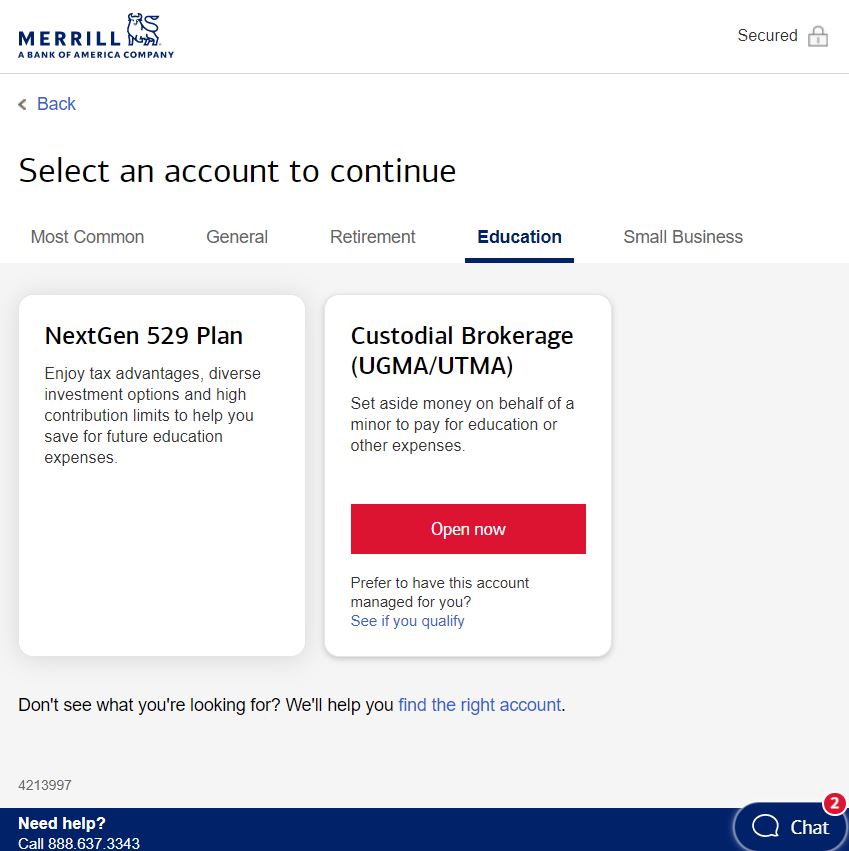

Opening the UGMA or UTMA at Merrill Edge

When you’re ready to open your custodial account, go to MerrillEdge.com and click on the red Open an Account button at the top of the page. On the next page, you’ll have two options: Help me get started and Show me all accounts.

With the first option, you’ll be asked a series of questions, and your answers will lead to a recommendation. The second option shows you a list of accounts, and you just click on one. You can try the first option if you like, but since you already know the account you want, you might prefer Show me all accounts. On the next page, just click on the Custodial Brokerage link.

When filling out the application, you’ll need details for both the minor and custodian, including their Social Security Numbers.

Although Merrill Edge offers several managed account options, they can’t be used for a UGMA or UTMA account. So you’ll need to make all the investment decisions on your own within a custodial account at Merrill Edge.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Better Custodial Account

One of the largest and most highly rated brokerage firms,

Charles Schwab, offers $0 commission on stocks, ETFs, and 4,200 mutual funds. There are no account fees at all. Charles Schwab has a richer selection of mutual funds and the best trading and research tools.

Free Charles Schwab Account

Open Schwab Account

Updated on 10/3/2024.

|