|

Moomoo (FUTU) Assets Under Management (AUM) in 2024

Moomoo total assets under management (custody). FUTU AUM and number of customers (user accounts).

|

Futu (including Moomoo) Assets Under Management (AUM)

| Futu client assets |

HK$369.6 billion |

| Number of customers |

19.2 million |

| Total number of paying customers |

1,444,955 |

| Total revenues |

HK$1,945.6 million |

| Net income |

HK$754.6 million |

Moomoo is a mid-size brokerage company by assets.

However, it is extremely small when comparing total assets under management to

Charles Schwab, who has

$9.57 trillion in AUM and over 35.7 million customers.

Free Charles Schwab Account

Open Schwab Account

Moomoo Overview

If you are looking for an online broker with great promotions, Moomoo is a broker you may want to consider.

The promotional offers at Moomoo are especially appealing for anyone interested in free stocks, as there are multiple opportunities to start a trading portfolio even before purchasing your first stock. Free stocks are offered for creating a new account, funding a new account, and inviting friends and family to join the broker.

Keep reading to learn more about the promotional offers and why you might want to invest your time and money with Moomoo.

Notable Features

Before considering the promotions a stockbroker offers, it’s wise to first decide if you are interested in the broker's fundamental offerings. Fortunately, Moomoo has many attractive features, making it an easy choice.

Here are some aspects that make Moomoo stand out:

Market Insights

Moomoo simplifies investing by providing extensive market data, news, trends, and more.

Market-specific data, such as Level II market data, company financials, analyst ratings, and more. Notably, Level II data is provided at no additional cost to traders, which is always a bonus.

Additionally, news feeds are streamed to investors 24/7, keeping traders updated as global economic conditions change. The platform also includes a social aspect, allowing investors to see which tickers are trending and what public opinion is suggesting.

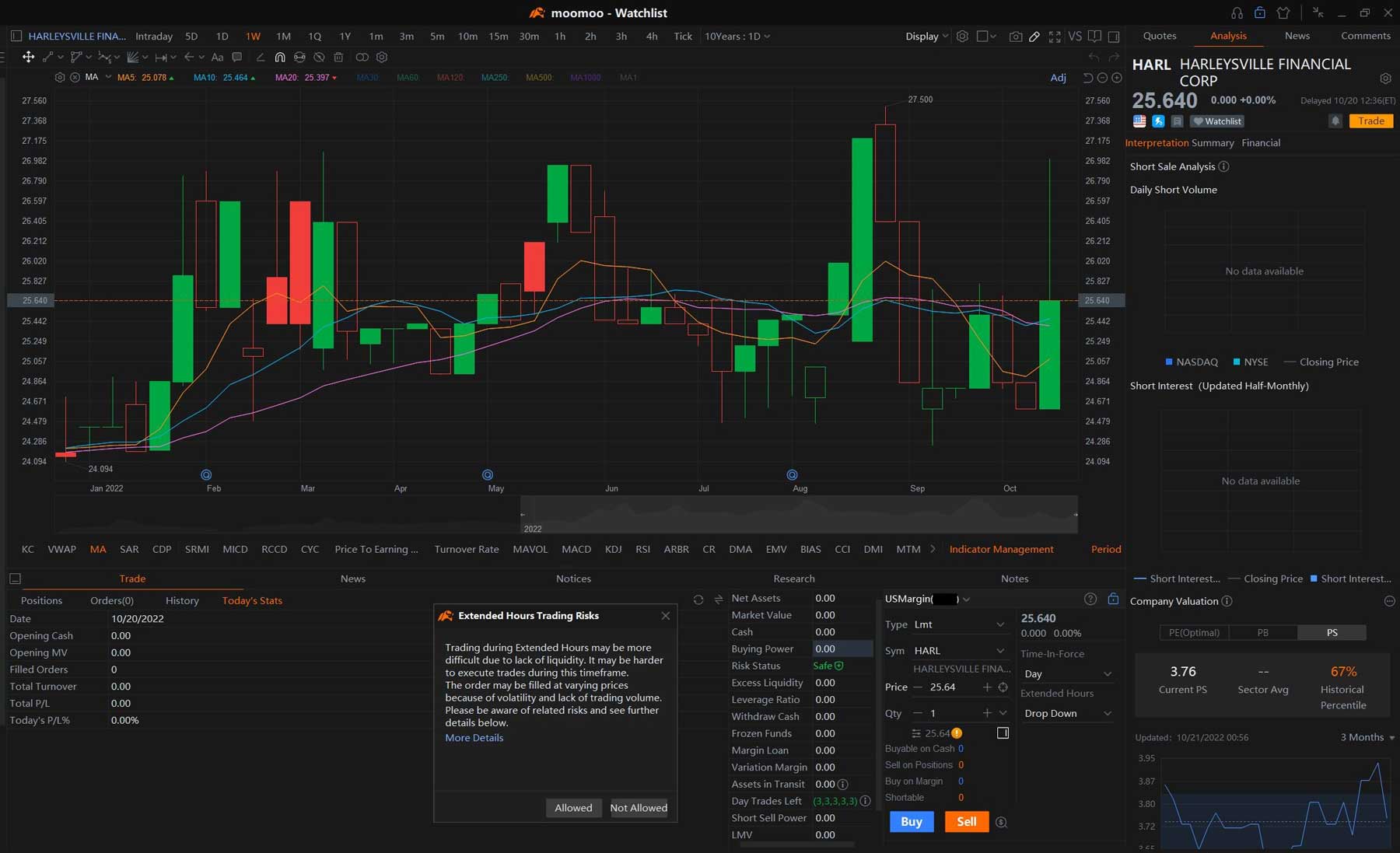

Charting and Platform

Another appealing feature is the broker's focus on mobile accessibility.

In today’s mobile-centric world, it is crucial for brokerage firms to respond accordingly.

Moomoo clearly understands this need. The broker offers advanced charting and order placement capabilities on mobile that are easy to use and always accessible.

Fee Schedule

Following the trend of popular brokers in the United States, Moomoo offers commission-free trading in stocks, ADRs, and ETFs.

Market Access

Traders at Moomoo have access to a wide range of tradable assets. Whether it’s a full listing of Hong Kong-listed stocks, IPOs, ADRs, ETFs, or US stocks, the list of options is extensive. Moomoo also remains open for the entire extended trading session, which sets it apart from some other mobile-first brokers in the industry.

Updated on 7/5/2024.

|